-

02Jun2020

Tax Time 2020 – Covid and Other Challenges

The time to prepare for the end of the financial year is BEFORE 30 June. Seems simple when you say it – but many businesses do find it challenging – which is why reaching out for help from professional advisers like your tax accountant can be important.

Reviewing your business performance and maximising your tax outcome for the year can go hand-in-hand – and will help ensure no nasty surprises emerge when your accountant finishes your yearly results.

With this in mind, we’ve put together a list of things to start thinking about and getting prepared to be on the front-foot for tax time 2020.

These are all general tips for you to think about – some specifically relate to your potential tax outcome and others are business operational matters that could be worth considering.

30 June and Tax Time

Find out how to prepare for tax time 2020 HERE!

-

28May2020

Understanding the ATO Instant Asset Write-Off

The ATO’s instant asset write-off is another form of financial relief the ATO and the Federal Government has included and expanded on in the COVID-19 relief schemes. First developed in 2015 as a way of enabling small businesses to claim the depreciation amount of a work-related purchase like a car or a computer in one hit, rather than gradually over a number of years. Recently, the ATO expanded on the criteria needed for this asset write-off. If you are a business owner or sole trader interested in the instant asset write-off, read on to find out how the scheme works.

What is the ATO Instant Asset Write-Off?

The instant asset write-off scheme was initially introduced in 2015 and was largely aimed at helping small businesses claim the depreciation amount of company assets immediately, rather than over many years. The onset of the COVID-19 pandemic has seen the government and the ATO introduce a number of financial relief schemes aimed at helping businesses survive this troubling time, and recently, they adjusted the criteria for the instant asset write-off scheme to include larger businesses.

As part of the ATO and the government’s economic stimulus measures, the asset limit for the instant asset write-off scheme has increased from $30,000 to $150,000. The pool of eligible businesses has also been amended from those with an aggregated turnover of less than $50 million, to an aggregated turnover of less than $500 million. These significant changes will see the instant asset write-off scheme benefit many more businesses than before.

This means that a greater number of businesses can purchase a piece of equipment or a company vehicle and receive an immediate deduction of up to $150,000. However, the relief scheme is not without strict regulations that must be adhered to if businesses are to utilise this financial relief benefit to its maximum, and there is some confusion in particular around how the scheme works for company-owned and bought vehicles.

What is the ATO Instant Asset Write-Off Limit on Cars?

While the instant asset write-off limit has increased from $30,000 to $150,000, a ‘car cost limit’ has been implemented for businesses wanting to purchase a vehicle at this time. This will define the amount you can actually claim on a newly purchased vehicle.

Specifically, cars that are “designed to carry a load less than one tonne and fewer than nine passengers,” have a total claim limit of $57,581 and anything beyond that point “cannot be claimed under any other depreciation rules,” the ATO explains.

However, the full purchase price of a vehicle which can carry more than one tonne/more than nine passengers can be claimed back.

Cars that cost $150,000 or more, as well as farm trucks and tractors, are ineligible for the instant asset write-off scheme.

Does the Car Threshold Include LCT, On-Road Costs, Insurance and Registration?

All costs but insurance and registration are included in the car threshold amount – this includes stamp duty, any accessories, luxury car tax, on-road costs and delivery.

Insurance and registration are recurring business costs, which are immediately deductible under the general deduction provision and thus not included in the cost of the car.

Are Lease and Financed Cars Eligible?

A hire purchase lease will be eligible for the instant asset write-off scheme, but operating and finance leases will not qualify.

Criteria for the ATO Instant Asset Write-Off: Cars

- Must be a business asset. Any old asset will not comply. Whether it’s a new or second hand asset, to get the 100% deduction the asset must be 100% employed in your business. Assets that are part business and part private will require a log book to establish a business use percentage.

- Car limits may still apply. A passenger vehicle designed to carry a load of less than 1 tonne and fewer than 9 passengers is limited to a maximum write-off of $57,581 – even if it 100% used in business. Vehicles that are greater than one tonne or carry 9 passengers or more may be eligible for a higher write-off amount.

- You must own and be using the asset by 30 June. The asset must be owned by the business and be in use (or able to be used) by the business by 30 June to claim the write-off.

- Employees are not eligible for the instant asset write-off scheme, but they may be able to claim back some of their own car usage.

Many car dealerships are calling for the extension of the scheme to allow more businesses to take advantage of it.

Choose Affinitas Accounting

The ATO’s instant asset write-off can provide a major financial aid to many businesses. If you think you are eligible and want to apply, please feel free to contact one of our friendly business accountants for swift, prompt assistance.

-

28May2020

JobKeeper Explained: What is it and Who is Eligible?

JobKeeper was introduced in April 2020 and is an effort being made by the Federal Government to support eligible businesses effected by COVID-19 to cover the costs of their employee’s wages, on condition that the business has experienced a loss of a predetermined portion of their turnover. Around $130 billion will be paid to hundreds of thousands of Australian businesses to subsidize employee wages. If you are a business owner who wants to explore JobKeeper and want to know if you can apply, read on to find out how it works and who is eligible.

What is JobKeeper?

The Coronavirus Economic Response Package (Payments and Benefits) Act 2020 came into effect on 9 April 2020 (though the payment scheme was officially backdated to 30 March 2020), which allowed for the implementation of the Federal Government’s $130 billion JobKeeper relief scheme. It forms part of the Government’s $320 billion total economic stimulus and support package for businesses and employees affected by the Coronavirus (COVID–19) crisis. The scheme was aimed at keeping Australians employed even in the event of their employer temporarily closing down due to trading limitations caused by the outbreak.

Businesses who were impacted by COVID-19 and who suffered a loss in turnover of at least 30% can apply for the JobKeeper fund which will give them access to a wage subsidy for their employees. Eligible employers will be able to continue to pay their employees on a fortnightly basis: $1500 per employee from March 30 2020, for a maximum period of 6 months.

For those in non-essential industries, such as accommodation, retail and hospitality, this subsidy payment equates a complete wage replacement – something those working in the hardest-hit industries would need.

The JobKeeper payment scheme will end on 27 September 2020, encompassing 13 fortnights of employee wage payments.

Who is Eligible for JobKeeper?

In an effort to provide support and financial assistance to businesses and employees who need it, the Government has set out a defined list of criteria that businesses need to meet in order to apply for the JobKeeper payment scheme. The eligibility criteria are:

- Businesses that have experienced a loss in turnover of at least 30%, in a month-long period compared to last year

- Businesses that have experienced a loss in turnover of at least 50% if they usually bring in more than $1 billion annually, in a month-long period compared to last year

- Charities that have lost at least 15% of their turnover in the same period

- Applicants who have casual workers must have employed the casual worker for at least a year

- Sole traders

- Temporary work visa holders may not apply unless they are New Zealanders on the special 444 subclass visas

Sole traders and some other entities (such as partnerships, trusts or companies) may be entitled to the JobKeeper Payment scheme under the business participation entitlement. A limit applies of one $1,500 JobKeeper payment per fortnight for one eligible business participant. Sole traders, one partner in a partnership, one beneficiary of a trust, and one director or shareholder of a company may be regarded as an eligible business participant.

How do the JobKeeper Payments Work?

Eligible employers and companies will be able to claim the subsidy amount of $1500 per eligible employee on a fortnightly basis. However, the Australian Tax Office (ATO), who has partnered with the Government during this crisis, will pay employers in arrears, within 14 days of month end. The employer will continue to receive the subsidy payments for eligible employees while they are eligible for the payments. While the program is expected to run for 6 months, payments will stop if the employee is no longer employed by the business.

Monthly employer payroll reporting is required to trigger the payment by the ATO using Single Touch Payroll (STP).

JobKeeper Obligations and Risks

While the JobKeeper payment scheme is aimed at helping businesses and their employees, the system is not without risks that business owners should be aware of.

If an incorrect claim is made, or if the ATO in the future decides that you were ineligible to receive the JobKeeper payment, the ATO will require you to repay any JobKeeper payments that you have received, plus penalties and interest.

The key risks and responsibilities you, as the employer, must be aware of include:- The employer certifies the facts provided to the ATO and the JobKeeper claim made

- The employer receives significant JobKeeper payments over a 6 month period. For example, an employer with 5 employees would receive $97,500, and an employer with 10 employees would receive $195 000

- If the employer makes a mistake and is found to be ineligible by the ATO (for example, its turnover was not down by 30%), then they may have to repay all amounts received back to the ATO This is not recoverable from employees (unless they confirmed they were eligible but were not)

- An employee ceases to be eligible if they cease employment during the life of this JobKeeper scheme

- The ATO requires you to keep all records in relation to your JobKeeper claim for a 5 year period.

How to Apply for JobKeeper

The ATO has specific actions that must take place within tight time frames for an employer to receive the JobKeeper payment. If you want to apply for JobKeeper for your business, please contact us or read the below:

1. Employer Eligibility Assessment

- Review ATO requirements for the business

- Review ATO requirements for employees

- Review ATO requirements for Business Participation Entitlement – Sole Trader, Partnership, Company or Trust

- Document the fall in turnover % in case of future ATO audit

2. Identify Eligible Employees

- Prepare list of eligible employees

- Prepare JobKeeper employee nomination notice for all eligible employees and ensure

all notices are signed

3. Make Correct Wage Payments to Eligible Employees

- Ensure your payroll software is correctly set up to record JobKeeper “top up” payments

- Pay the minimum $1500 before tax to each eligible employee each fortnight (starting with the fortnight 30 March to 12 April) to be able to claim the JobKeeper payment for that fortnight

- Continue to pay the minimum $1500 to employees in every subsequent fortnight until 27 September 2020

4. Enrolment for JobKeeper

- Enrol for JobKeeper using ATO online services from 20 April 2020

- Provide employer bank account details for receipt of JobKeeper payment

- Confirm if applicant is entitled to a “Business Participation Payment”

- Specify the number of employees who will be eligible for one period and the number eligible for two periods

- Get confirmation that all employees the employer plans to nominate are eligible and the employer has notified them and has their agreement

5. Apply for JobKeeper Payments

- Apply to claim the JobKeeper payment using ATO online services between 4 May 2020 and 31 May 2020

- Ensure all eligible employees have been paid $1500 per fortnight

- Identify the eligible employees from a Single Touch Payroll prefill or by manually entering into ATO online services

- Update your accounting system Chart of Accounts to ensure JobKeeper payments are coded correctly

6. Monthly JobKeeper Declaration Report

- Using ATO online services, report to the ATO using their Monthly JobKeeper

- Declaration Report on the following:

- Reconfirm that your reported eligible employees have not changed

- Input current GST Turnover for the reporting month

- Input projected GST Turnover for the following month

- Notify if any eligible employees have changed or left your employment

Partner with Us

We want to do our part during the pandemic and, as such, are providing support and assistance to businesses who want to apply for the JobKeeper payment scheme. Please be sure to contact us if you or your business require assistance with your application.

-

25May2020

Common Tax Scams

Common Tax Scams

Common tax scams hit hundreds of Australians every year around tax time. In fact, according to Scamwatch, scammers cost Australians $489 million in 2018!

Tax scams are a major problem for individuals and businesses around Australia, with many people falling victim to fraudulent emails, phone calls and text messages, identity theft and more each year. Scammers claim to be from reputable organisations, pretend to be registered tax agents or even claim to be from the Australian Tax Office (ATO), using convincing language to fool individuals into handing over personal information and money.

The best way to protect yourself and your finances against these common tax scams is to be aware of them and understand how they work. This will allow you to quickly identify and report any suspicious correspondence you receive. Keep reading to find out what the most common tax scams are and how you can protect yourself against them.

Common Tax Scams: Fraudulent Tax Preparers

Every year during tax time, many individuals and businesses choose to employ the services of accounting firms for their annual tax return submission. Scammers know this and use it to their advantage, posing as tax preparers and tax services providers in order to fraudulently obtain personal information.

A common tax scam that occurs sees scammers portray a tax preparer or accounting service provider, and then charging or requesting from their customers an upfront fee. They usually stipulate that this fee is to cover their tax return services, but once an individual has paid this fee and fallen for the trap, the scammer will disappear – taking your money with them!

Some scammers collect your personal information and sell it to other malicious entities who can then conduct other fraudulent activities, such as credit card fraud or identity theft. Personal information can even enable scammers to intercede your tax returns and receive them in your stead.

Common Tax Scams: Phishing

Phishing is a very common tax scam that occurs year-round to thousands of people. It is not unique to tax time, but phishing is an issue that many businesses and individuals have to deal with during tax season.

Phishing can be in the form of fake emails, advertisements, text messages and even whole websites. Typically, the goal of phishing scams is to collect personal and financial information about a person or business, and then use this information to steal their money, or sell this information to other scammers and unscrupulous characters. Scammers will often pretend to be from a reputable organisation and mimic them in order to gain your trust and help convince you to provide the information they need.

This type of common tax scam is especially worrying because scammers usually mimic organisations like your bank, your accountant or accounting firm and even the ATO. This makes it easy to fall for the scam and unwittingly provide you information to scammers.

Scammers who use phishing techniques can also remotely install malicious software on your computer or laptop by getting you to click on a link they sent in a fraudulent email or text. A convincing email or text will persuade you to click on the link, which then installs viruses or hostile software on your computer, which can provide access to your stored data, information and personal files.

Common Tax Scams: Small Business Scams

Small businesses are often the target of common tax scams, especially around tax time. These scams can be in the form of phishing emails, texts or phone calls, which can be sent to anyone in the company.

A very common tax scam that small businesses experience is receiving a bill or invoice for so-called services that were provided to your company by another organisation. Around tax time, these falsified bills and invoices usually refer to tax services rendered to a business and can even threaten a small business with a loss of their returns if they do not comply.

How to Protect Yourself Against Common Tax Scams

Scammers are getting smarter and more crafty every year, changing and improving their methods to rob you of your personal and financial information. Technology has made it easy for scammers to contact and harass you, and even easier to obtain private information. The best defense any business or individual has is awareness and good habits. Here are some ways you can protect yourself or your business from common tax scams:

- Protect private information such as your full name, your date of birth, your tax file number, your current address, banking and financial details and even your drivers license details. This information can provide scammers with the ideal gateway into your life and make stealing your information, and your money, even easier.

- Treat requests for personal information with suspicion, as not all requests are legitimate. Even if you receive an authentic-looking request from a service provider you recognise, such as your bank or tax accountant, be cautious and ensure you are dealing with the legitimate organisation before providing any personal information or clicking on any links contained within the email.

- Ignore requests for payments sent on email or via text message before validating them.

- Avoid sharing too much information on social media or other public platforms. This will protect you from having your personal information stolen and prevent you from being a victim of identity theft.

How to Handle Common Tax Scams

If you have been scammed or suspect fraudulent and illegal activity, the best way forward is to report the incident with as much information as possible. The ATO has dedicated points of contact for people who need to report scams. Reporting suspicious emails, texts or phone calls can help stop scammers and helps create awareness around this growing problem.

Get Professional Accounting Services

Affinitas Accounting is not just one of the many accounting firms in Brisbane. Our team is committed to helping you get back in control of your finances.

Our Brisbane Accounting firm holds over 20 years of collective experience in delivering high-quality accounting services to individuals and business owners alike. We work with businesses, professionals and individuals offering a comprehensive plan to foster growth, improve cashflows and increase profits. Our accounting firm offers a variety of services ranging from business management and taxation to risk assessment and cash flow advice.

Affinitas Accounting can offer you:

- Timely communication

- Excellent advice

- Fixed Price Quotes

- No charge for phone call enquiries

- Experienced Specialists.

Need accounting services? Contact us today!

-

25Jul2019

Tax Season Starts With Big Bang

The much-talked-about 2019 tax cuts are now legislation and it certainly seems to have sparked taxpayers into action in relation to lodging their 2019 tax returns.

So much so – that the ATO computer and phone systems already have gone into meltdown and been offline on quite a few occasions.

I suppose it’s only natural that people want the extra money as soon as possible – but remember, only people who actually PAY tax can benefit from the offset of up to $1100 and there are income restrictions for what you are actually entitled to.

It is not a cash handout.

Other things to think about for tax season are:

As always, we can pick up a lot of information from the ATOs Pre-Filling Reports, probably more then ever – but we may not have all of it just yet. For example:

-

10May2019

Add Value at Tax Planning Time

The months of May and June are always busy times in the world of tax and accounting.

Not only are we finishing the last of our tax returns for the 2018 financial year, but we are tax planning with clients for the 2019 tax year.

Why Is Tax Planning Important?

It provides each business the opportunity to assess their potential tax situation PRIOR to 30 June each year. This gives a business time to either plan for the expected result and/or implement legal strategies to reduce their tax. Finding out you have a larger-than expected tax bill after 30 June is too late – because there is nothing you can do to reduce it.

How Does The Tax Planning Process Work?

By early May, we should have your business results up until 31 March – the end of the third quarter. Based on these figures, we can usually project your annual profit with a fair degree of accuracy. To do this we consider historical data from previous years, plus an estimate from the business owner/s of their projected last quarter results. And we do not just consider the figures in the business entities, but we include how that profit will potentially flow through to other entities or onto individual tax returns.

Uncovering Tax Opportunities

Sometimes there are opportunities within the business to reduce your taxable income. These can include pre-paying expenses; writing off bad debts, or obsolete stock and equipment, or contributing extra into superannuation for company directors. The immediate write-off of business assets up to $30,000 also could be useful to pick up new assets needed by the business and claim a full tax deduction prior to 30 June.

Broader Value Of Reviewing Your Numbers

Smart business owners will take the time to stop and assess how their business is travelling as year end nears. How do the figures compare with previous years? Are there any line items in the accounts that tell a story? For example, has any particular source of income greatly increased or decreased? Have expenses like wages or cost of goods sold increased and reduced your profitability? What about the balance sheet? Is your cash position getting low? Are trade debtors or trade creditors increasing? Are your tax debts or long term liabilities increasing? Picking up on trends in your numbers – good or bad – can help you put plans in place and set a strategic direction to navigate your business in the right direction.

Front Foot Business Review

This end of year process can be taken even one step further, via a formal business review. Called a Front Foot Business Review, we run through a comprehensive checklist with management, designed to check whether the operational, strategic, marketing, risk, insurances, partnership/directors agreements, leases and succession plans are in place and current. This review almost always highlights at least one or two areas that require work to be done.

To ensure you are making the most out of the 2018-2019 tax planning season, contact us on or phone 07 3510 1500.

-

03May2019

Taxing times as voters weigh up election options

On Saturday, May 18, Australians will vote to choose the our next Federal Government.

At every Federal poll there are many different candidates with many different policies – but ultimately all policies need to be paid for – and the vast majority of that money comes from taxes collected by the ATO.

This election contains proposed changes to tax law from various parties that could have a significant impact on investors, small business owners and salary and wage earners alike.

It is not our intention (or our place) to suggest any particular strategy with regards to your voting. However, as professionals in tax and accounting, we felt that our clients and other followers may find the table below a useful summary of the key tax issues and impacts of the policies being supported by three of the parties likely to have a major say in the election outcome.

We have included links to articles that explain each issue in more detail, as they are currently available. We encourage you to read up on these and engage in conversations with your current local member, or those contesting the seat in your local electorate.

And yes, we acknowledge there are other parties, such as the United Australia Party and One Nation, who also have published tax policies. These can be found via a quick Google search – and we encourage you to do so if you are interested.

We have seen many times over the past three decades that what is promised during an election campaign and the final legislation passed can be very different. But it still helps if you can head into the voting booth with a working knowledge of what each party is promising AND how they intend to pay for those promises. Always remember, it is YOUR money they are collecting and spending.

Liberal

Labor

Greens

Negative Gearing

No change

Limit negative gearing to new housing

from 1 Jan 2020. Any investments made prior to the changes will not be affected.

If you buy an established house as a rental property or borrow to invest in shares (as examples) and your expenses are more then your income, from 1 Jan 2020 you will not be able to use those losses to offset any of your other income.

https://www.alp.org.au/negativegearing

Remove all negative

gearing for property investors

CGT Discount

No change

Reduce the capital gains discount for assets held longer then 12 months to 25% from 1 Jan 2020. (currently 50%)

This could increase the tax you pay on not only investment property sales but also share, business and other investments sales that make a capital gain.

Remove all CGT concessions for property investors

Franking Credit

No change

Making franking credits a non-refundable offset, proposed to come in to effect 1 July 19. Their pensioner guarantee sees pensions protected from these changes as well as pre-existing self-managed super funds.

While franking credit can still be used to reduce tax payable, no cash refunds for unused franking credits will be given. This means dividends would be taxed at the individuals nominal tax rate.

https://www.chrisbowen.net/issues/labors-dividend-imputation-policy/

No change

Small Business deductions

Instant asset write-off of $25,000 will apply until 30 June 2020

Immediate 20% deductions for eligible business assets (currently 15%)

No change

Deduction for managing tax affairs

No change

Limiting deductions on managing tax expenses to $3,000 per individual per year.

No change

Super deduction for individuals

No change

Remove the recent changes made to deductibility for personal super contributions & catch-up concessional contributions

No change

Taxation of trusts

No change

Put a minimum 30% tax on distributions made to adults from discretionary trusts

No change

Non-Concessional contributions & Division 293

No change to current cap

Lowering annual cap to $75,000 (currently $100,000) and Reducing threshold to $200,000 (currently $250,000)

No change

Tax Rates

Doubling the low and middle-income tax offset to $1,080, raise the threshold for the 19% tax rate from $41,000 to $45,000 in July 2022 and flatten tax brackets so everyone earning between $40,000 to $200,000 pays a marginal rate of 30% from 2024.

Doubling the low and middle-income tax offset to $1,080 and increase tax cuts for people earning less then $48,000, including a $350 tax cut for workers earning up to $37,000.

Increasing the top individual rate from 45% to 49% for earnings over $180,000

https://www.alp.org.au/tax_refund_for_working_australians

Doubling the low and middle-income tax offset to $1,080. Repealing the income tax cuts from 2018 & reintroducing the deficit levy permanently, increasing the tax rate of a person earning more then $180,000 by 2%. Increasing company tax rate to 30% for businesses earning more then $10m a year.

Useful links comparing tax policies

Contact us if you have any questions about how these policies apply to you and your tax planning.

-

26Apr2019

What Should You Be Doing To Get Ahead While Interest Rates Are Low?

In the last blog in this series, we looked at the difference you can make to the cost of your mortgage by ensuring that you’re not paying over the odds on rate, as well as some of the complexities around rate that need to be considered when refinancing.

Here I’m looking at how you can set up some healthy financial habits that will not only reduce finance related stress and smooth your cash flow, but also save you thousands on interest and years off your mortgage.

Each time you look at your mortgage, this involves looking at your family budget. While this doesn’t usually top the list of the way we like to spend our time, there is an upside to the exercise if we can leverage it to your advantage . It often presents an opportunity to better manage cash flows and through this it can make a huge difference to your bottom line, especially if the changes can be automated.

There are a few categories of savings that make sense for everyone to have:

- Emergency savings – depending on your age and commitments a good target is somewhere between 3 and 6 months net income. How much you need in this category to feel secure will also depend on your personal risk profile and how easily you might be able to replace your income through finding a new role in the event of retrenchment etc. These should be funds that you don’t dip into for anything else.

- Cash flow savings – these are funds set aside from each pay check to cover expenses that you know are coming, but are paid less frequently than your pay cycle. These could include quarterly bills like rates, body corporate fees, electricity etc. There are simple ways to work out how much you should be setting aside that don’t involve a weekend of wading through bills.

- Home loan repayment savings – by calculating what your home loan repayment would be if rates went up by even just 1% and setting the difference aside, you’ll not only have a buffer in place if rates do rise but you’ll also have the benefit of extra savings on your mortgage that increase at a compounding rate each month.

- Fun – Savings for holidays or family adventures and activities that cost more than you can cover in any given month. Some of these savings may go towards extra expenses at Christmas etc, these could also be savings towards that trip of a lifetime.

A real life example:

It’s often easier to see how powerful these strategies can be by looking at a real life example. Let’s take a young family with two kids on a reasonably tight budget. After tax, their total family income is $80 000 a year.

Their goal is to have emergency savings of 3 months net income, or $20 000. As they have recently bought their first home and then had their second child, their savings aren’t substantial. They’ve set a target to work towards having their emergency savings in place over 3 years, so they’re saving $ 500 per month towards this.

Their living expenses each month are around $4000 per month, excluding their mortgage. Of this around $1250 are bills like electricity, rates, school fees, rego and insurance that are paid quarterly or annually. The balance of $2250 includes general living expenses and a monthly fun budget.

They are setting aside $400 per month towards family holidays and extra expenses over Christmas time and birthdays.

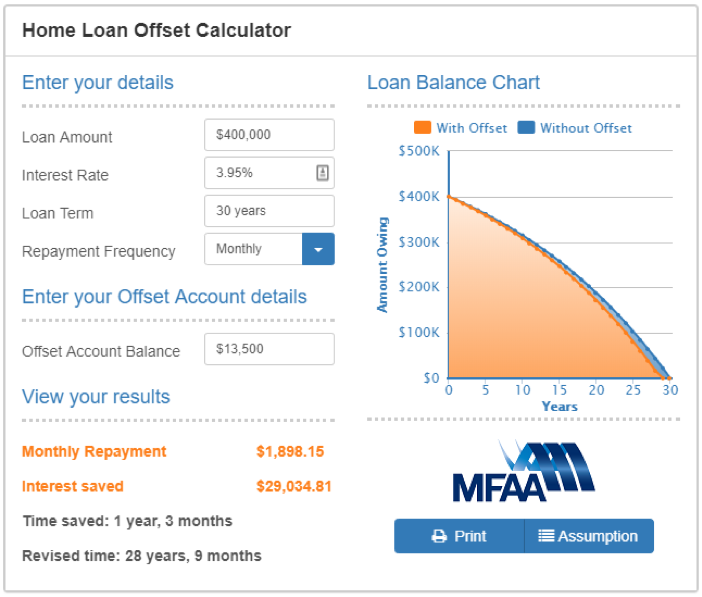

Their home loan is the same one we calculated savings on in the previous blog — $ 400 000 where we reduced the rate from 4.25% to 3.95%. They kept their repayments the same even though their rate dropped, so they’re already part of the way there on the changes they need to make to ramp up their home loan repayment savings.

Their home loan repayment savings are set at repayments at 4.95% less their actual minimum repayment at 3.95%. On their $400 000 mortgage, this equates to $ 236 per month in addition to their mortgage repayment of $1900pm.

To see how this works for them, let’s look at where they are at the end of the first year, and then at the end of year 3.

At the end of 12 months, their savings balances are :

Emergency savings $ 6000

Cash flow savings $ 3125 (approx. 2.5 months of monthly amount saved as expenses are paid from these savings)

Fun savings $ 1600 (assuming around 2/3 of the fun savings used and the rest saved towards longer term adventures)

Home loan savings $ 2832

Total savings $ 13557

In year 2, they’ll save around $533 in interest (on their $ 13 500 saved) but over the life of the loan, with no further savings, this would be savings of almost $30 000 in interest and a little over a year off their mortgage.

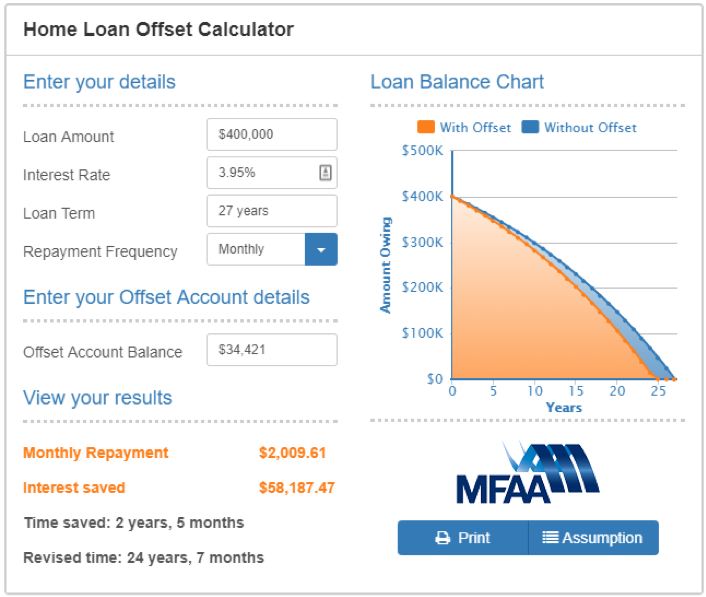

Let’s roll this forward for another 24 months assuming they continue to add to their savings:

Emergency savings $ 18000 ( 36 months at 500 per month)

Cash flow savings $ 3125 (average balance)

Fun savings $ 4800

Home loan savings $ 8496

Total savings held $ 34421

At only 3 years in, if they did nothing more (and maintained this level of savings) they would save $ 58187 in interest and 2.5 years off the mortgage over the life of the loan.

Not only have this family achieved their peace of mind goals of having 3 months income set aside for emergencies, they now have a buffer in place to protect them in the event that interest rates rise. On top of that they’re on their way towards their goal of a fabulous family holiday adventure.

At this stage, happy with the level of their emergency savings, they could split the $500 per month and add half to the home loan repayment savings and half to fun savings, ramping up their financial goals and their fun!

By spending a little extra time upfront getting advice on a personally tailored home loan strategy supported by the right structure, and an automated savings plan set up with their loan, they’re achieving all these goals and saving almost $ 60 000 in interest and 2 and a half years off their mortgage.

If you’d like to see how powerful keeping your savings in offset could be on your mortgage, visit my website at www.affinitasfinance.com.au/calculators/

If you’d like to chat about a personalised strategy, get in touch on 0430 383 996 or .

This article was originally published on Affinitas Finance.

-

12Apr2019

Instant Asset Tax Write Off Increased to $30, 000 — Effective Now

Tax planning opportunity via asset write-off increase

The biggest potential tax bonus for small business in the 2019 Federal Budget was the announcement that the instant asset write-off had been increased and offered to more businesses.

The instant asset write-off threshold for small businesses (with an aggregated turnover of less than $10m) will be increased to $30,000 for eligible assets that are first used, or installed ready for use, from 7.30 pm (AEDT) on 2 April 2019 (Budget night).

The extension is until 30 June 2020 – but qualifying businesses have between now and 30 June 2019 to purchase and fully deduct eligible assets up to the $30,000 threshold in this tax year.

This could be mean office equipment, machinery and even motor vehicles can potentially be upgraded between now and 30 June 2019 and be 100% tax deductible.

The original threshold of $20,000 already had been increased to $25,000 from 29 January 2019 for businesses with turnover up to $10m. But from Budget night, the new $30,000 immediate write-off threshold applied to all businesses with an aggregated turnover up to $50m.

To claim the write-off, items purchased must be first used or installed ready for use by the appropriate cut off date – either 30 June 2019 or 30 June 2020.

The new qualifiers, medium sized businesses (with aggregated annual turnover of $10m or more, but less than $50m) only qualify from Budget night.

The current rules general rules regarding accelerated depreciation for small businesses will remain in place. Therefore, assets that cannot be immediately deducted will need to be pooled and depreciated at an initial rate of 15% in the first year and 30% in each subsequent year.

However, small business depreciation pools valued under the instant asset write-off threshold at the end of the income year can be immediately deducted. The current “lock out” laws for simplified depreciation rules, which prevent small businesses from re-entering the pooling rules for five years if they opt out, will continue to be suspended until 30 June 2020.

Medium sized businesses do not have access to the small business pooling rules and will instead continue to depreciate assets costing $30,000 or more (which cannot be immediately deducted) in accordance with the existing depreciating asset provisions in the tax law.

Overall, it’s good news and a great tax planning opportunity that you should discuss with your accountant between now and 30 June as part of your annual business review.

-

05Apr2019

Affinitas Hails A New Service Champion

At Affinitas, it has never been our goal for clients to be merely satisfied with our service.

We want them to be AMAZED with what we offer, BLOWN AWAY with how we offer it and RAVING FANS of the overall experience of being an Affinitas client.

To underline our commitment to this ethos, Affinitas has appointed a Client Service Champion.

Affinitas Accounting partner Tanya du Preez has been appointed to this role. Tanya is a trained and qualified accountant, but her day-to-day speciality is finance rather than working in the tax team.

Sitting outside the tax/accounting team puts Tanya in an ideal position to give clients an outlet to discuss their experience as an Affinitas client.

Tanya sees her role as being responsible for making sure the Affinitas team delivers more than just professional advice and timely service.

“We believe you also deserve an amazing experience as part of the package in dealing with us,” Tanya says.

“We all love to hear when we’ve done things well, but we improve by hearing what we could do better.”

“Our team culture around feedback is a really positive one, so please feel free to tell us what you think, especially if we have dropped the ball in any way.”

Ensuring clients are aware of the full range of services that Affinitas offers, and accessing the ones they need, will also be an important part of Tanya’s role as our Client Services champion.

Affinitas clients – old and new – will all receive a welcome letter from Tanya to officially introduce herself in her new role.

There will be structured feedback opportunities, such as surveys, provided at the conclusion of various services to give clients an opportunity to provide feedback on their experience.

In addition, clients are welcome to contact Tanya any time on or by phoning the office on (07) 3510 1500. For urgent calls, Tanya can be reached on 0430 383 996.