-

04Sep2020

JobKeeper 2.0 – What We Know So Far!

The end of September will soon be upon us and businesses needing ongoing support must get familiar with the rules of JobKeeper 2.0.

The first thing to note is that businesses need to qualify separately for each extension period.

- To qualify for the first extension period, running from 28 September 2020 to 3 January 2021, small businesses will need to satisfy the 30% decline in the turnover test for the September 2020 quarter.

- To qualify for the second extension period, running from 4 January 2021 to 28 March 2021, small businesses will need to satisfy the 30% decline in the turnover test for the December 2020 quarter.

- Then, businesses need to understand the reduced payment rates that apply under a two-tiered system per period.

For the first extension period, employees who worked for 80 hours or more in the four weeks of pay periods before either 1 March 2020 or 1 July 2020 will receive $1,200 per fortnight, while all other employees will receive $750. For the second period, these rates will drop to $1,000 per fortnight and $650 per fortnight, respectively.

The ATO has announced that businesses currently enrolled in JobKeeper will not need to re-enroll for JobKeeper 2.0, nor will they need to provide an employee nomination notice again.

Further guidance on calculating the decline in the turnover test will be announced soon, but it will be expected to rely heavily on Total Sales (G1) less GST (1A) reported on business BAS for each relevant quarter. This figure will then be compared with figures from the same quarterly BAS, lodged 12 months prior.

An ATO spokesperson said additional turnover information may be allowed to demonstrate that businesses met the decline in the turnover test for the September quarter from the start of October onwards. The information must be provided before you complete your November monthly declaration.

Affinitas Accounting will be keeping up to date with any additional JobKeeper 2.0 information as it is released, so stay in touch and keep a lookout for more updates via email and social media.

Contact 07 3510 1500 or service@affinitasaccounting .com.au for more info

-

19Aug2020

Employers MUST Review JobKeeper By Friday 21 August

Employers must assess by this Friday (21 August) whether they are able to add extra employees to their August JobKeeper claim, following last Friday’s announcement by Treasurer Josh Frydenberg.

While the specific rules dealing with JobKeeper 2.0 have not yet been released, Treasurer Frydenberg announced some changes relating to employee eligibility under the current scheme.

Employers must understand the rules (see below), then identify and nominate all additional employees who could be eligible for JobKeeper by Friday 21 August to ensure that they comply with the “one in, all in” principle and that they meet the nomination requirements.

There has been lobbying to extend this deadline, but at this stage, the extra employee nomination notices must be provided within seven days of last Friday’s week’s announcement.

New test date for employees

Under the original JobKeeper rules, an employee generally needed to have been employed by the entity on 1 March 2020 and to have met certain conditions as at that date to qualify as an eligible employee. However, the Government has updated the rules to ensure that 1 July 2020 will be the relevant test date rather than 1 March 2020 from 3 August 2020 onwards, which means that some additional employees might become eligible for JobKeeper from the 10th JobKeeper fortnight onwards. Employees who met the conditions on 1 March 2020 will continue to be eligible assuming they are still employed.

In practical terms this means:

- If someone commenced employment with an entity after 1 March 2020 but by 1 July 2020 and they were an employee of the entity on that date then they can potentially be eligible for JobKeeper from 3 August 2020 onwards, assuming all other basic conditions are met.

- Casuals who had not been employed for at least 12 months leading up to 1 March 2020 can potentially be eligible for JobKeeper if they have been employed on a regular and systematic basis for at least 12 months leading up to 1 July 2020 (assuming all other basic conditions are met).

- Individuals who failed the age-related conditions or residency conditions on 1 March 2020 can potentially be eligible employees if they met those conditions on 1 July 2020.

Extended deadline for top-up payments

Crucially, the ATO has announced that the deadline for making payments for newly eligible employees for JobKeeper fortnights starting on 3 August 2020 and 17 August 2020 has been extended to 31 August 2020 (to meet the condition for employers to pay at least $1500 to eligible employees in each JobKeeper fortnight).

Employees who have moved to a new employer

The other key change to the rules is that someone who was previously nominated for JobKeeper with one entity as an eligible employee or eligible business participant can potentially be nominated for JobKeeper with a different entity if certain conditions are met. The individual must have ceased to be employed or actively engaged in the business (as a business participant) of the original entity after 1 March 2020 but before 1 July 2020. They must also meet the conditions to be treated as an eligible employee of the new employer at 1 July 2020.

Don’t Wait Until Deadline Day!!!

Businesses should get this done within the next week so that any changes can be calculated and included in the next JobKeeper lodgement is made for August. Let your accounting firm know early if you need help. Contact Affinitas Accounting on 07 3510 1500 or

-

07Aug2020

Good Lodgement Record Helps Everyone

Affinitas Accounting has statistically knocked the ball out of the park for the second year running, lodging 93.7% of client returns on time in FY2020.

The ATO’s benchmark for a good lodging practice is 85% or better. And despite the challenges thrown up by Covid-19, Affinitas was able to improve on the 92.3% mark achieved in FY2019.

It is important for taxpayers to realise that the ATO does not just track the lodgement record of each individual lodger. It also monitors the record of the tax agent who lodges your return.

The ATO issues certificates to practices who better the 85% benchmark in recognition that they are actively involved in assisting clients to meet their tax obligations in a timely manner.

There are times when accounting firms like Affinitas need to approach the ATO, on behalf of clients, to ask for lodgement extensions and other special consideration.

A good lodgement record does not guarantee a request will be granted, but the ATO does have the comfort of knowing that it is dealing with an accounting practice with high standards and that does its absolute best to ensure client lodgements remain up to date.

The Affinitas Accounting tax team is now busy creating it’s lodgement record for FY2021. Contact 07 3510 1500 or .

-

07Aug2020

August Deadline for ATO Contractor Report

ATO Widens Net as Contractor Report Deadline Looms

The Australian Tax Office has warned businesses that pay contractors may need to lodge a taxable payments annual report (TPAR) by 28 August 2020.

This year, many more businesses are included in the TPAR net, including those that pay contractors to provide road freight, information technology, security, investigation or surveillance services.

Businesses providing building and construction, cleaning or courier services are already required to report.

ATO assistant commissioner Peter Holt said businesses should take the time to check if they needed to lodge a TPAR. Mr Holt said that, due to COVID-19, many businesses had needed to contract out more services. He said the TPAR helped create a more level playing field in the contracting sector, which was already doing it tough.

“It is not fair if an honest contractor misses out on business because a competitor is undercutting them by doing things like under-declaring or not declaring income,” Mr Holt said.

The ATO is aware that many restaurants, cafés, grocery stores, pharmacies and retailers had started paying contractors this year to deliver their goods to customers as a result of COVID-19.

Mr Holt said these businesses may not have previously needed to lodge a TPAR.

“However, if the total payments received for these deliveries or courier services are 10 per cent or more of the total annual business income, you’ll need to lodge,” Mr Holt said.

The ATO expects more than 280,000 businesses to complete a TPAR for the year ending 2019–20.

If you own a business and think you may need to lodge a TPAR by the end of August, contact Affinitas Accounting on 07 33595244 or

-

21Jul2020

JobKeeper Scheme Changes

Government Tightens Purse Strings with JobKeeper 2.0

JobKeeper payments will be less and harder to qualify for under the next phase of the scheme.

The current $1500 per fortnight JobKeeper payment will be reduced to between $750 and $1200 per fortnight from 28 September 2020. The lower $750 rate will apply to employees working less than 20 hours a week.

As expected, Prime Minister Scott Morrison and Federal Treasurer Josh Frydenberg announced the changes on Tuesday, 21 July 2020, which will be the first part of the phasing out of JobKeeper payments by the end of March 2021.

From 4 January 2021, the rate will again fall to $1000 per fortnight and $650 for people working less than 20 hours a week. The program will run to 28 March 2021, at a further cost of $16 billion, taking the entire JobKeeper program to $86 billion.

New Eligibility Tests

New eligibility tests beyond September 2020 are expected to result in numbers of people on JobKeeper reduced from 3.5 million to 1.4 million in the December quarter and 1 million in the March quarter.

Businesses will still be required to demonstrate the required reduction in turnover – 30 per cent for businesses with turnovers of $1 billion or less, 50 per cent for those with turnover of more than $1 billion, and 15 per cent for ACNC-registered charities.

However, the government will now require businesses to demonstrate that they have suffered an ongoing significant decline in turnover using actual GST turnover, rather than projected GST turnover.

From 28 September 2020, businesses will be required to show an actual decline in turnover for the June and September quarters to qualify for JobKeeper 2.0.

From 4 January 2021, businesses will need to reassess their turnover to demonstrate that they have met the decline in turnover test for each of the June, September and December 2020 quarters.

Treasurer Frydenberg said employers would need to demonstrate that they had met the relevant decline in turnover in both the June and September quarters to be eligible for the JobKeeeper payment in the December quarter.

“Employers will need to demonstrate that they have met the relevant decline in each of the previous three quarters ending on 31 December 2020 to remain eligible for the payment in the March quarter 2021,” Mr Frydenberg said.

While there are currently 3.5 million workers covered under JobKeeper, Treasury expects the new eligibility rules to see the figure fall to just 1.4 million workers for the December 2020 quarter, before dropping to 1 million workers in the March 2021 quarter.

-

20Jul2020

July Tax Rush

Affinitas Accounting Clients Join the Billion Dollar July Tax Rush

Tax time 2020 is well and truly in full swing, with the ATO reporting its “biggest 1 July ever”, with over 740,000 online lodgements on that day alone, up from just 100,000 lodgements on 1 July 2019.

The first two weeks of July resulted in 1.7 million individual tax returns lodged, a 12 per cent increase on the same period last year. The average refund amount this year currently stands at $2,365.

ATO assistant commissioner Karen Foat said more than $1 billion had already hit taxpayers bank accounts, with processing continuing into the third week of July.

This busy start to the tax season has seen our Affinitas Accounting tax team working hard to keep up with demand. New online and remote systems of working have helped improve turnaround and efficiency.

Affinitas Accounting clients are embracing the convenience of virtual appointments and it is enabling more appointments to be held, and more returns to be processed, each day.

Affinitas Accounting’s senior tax consultant Deb Duncan says the new systems are working well. “I think people are this year finding remote returns so much easier and more convenient,” Deb said.

“I always look forward to catching up with a lot of my regulars during tax season, but we can still do this via phone, email and/or Zoom – just like we’ve all had to with our families and friends,” she said.

“And with the Covid-19 related health issues happening in southern states, we feel we are doing our little bit to help minimise anything like that happening in Queensland.”

Early mistakes

However, the ATO has urged early lodgers to take care in preparing their returns, with early analysis having revealed three trending mistakes.

Ms Foat said the first issue included claiming multiple working-from-home methods for the same period, with some taxpayers accidentally or deliberately confusing between the ATO’s recently introduced 80 cents shortcut method and its standard 52 cents fixed-rate and actual cost method.

“It’s important to remember that if you’re claiming under the working-from-home shortcut method for 1 March to 30 June 2020, you can’t claim any other expenses for working from home for that period,” Ms Foat said.

“If you want to specifically claim the depreciation of big-ticket items like laptops or desks, you can use one of the existing methods, but you can’t double-dip and claim under the shortcut method as well.

The second issue was where taxpayers simply copied and pasted their deductions from the previous year, failing to account for a reduction in claims due to COVID-19. In many cases, taxpayers will have reduced expenses for claims such as work related travel and uniform due to working from home.

The final issue was the failure to report all income, with prefill information unlikely to be 100% accurate so early into the new financial year.

“Unfortunately, we can confirm that approximately one in five people who lodged early won’t be getting their refunds in the first batches out because they didn’t take the time to include all their income,” Ms Foat said.

For those lodging early, it was crucial check information like cash wages, foreign income and all interest/dividends were included.

To book your virtual 2020 tax appointment, contact or phone 07 3510 1500.

-

06Jul2020

How to Make Your Business Saleable

Business owners know how important planning for the future is. But when it comes to planning, there is one element that many business owners fail to include: how to make your business saleable. Simply turning a profit isn’t always enough – there are many ways to ensure that your business is saleable. If you want to find out how to make your business saleable, read on!

How to Make Your Business Saleable: Key Factors

The new financial year is a time when small business operators review their operations and future plans. For most family firms, the business is their major asset and its eventual sale is what they are relying on to fund their retirement. But selling a small business is not like selling a house. You cannot just list it on the market and sell within 4-6 weeks.

Michelle Wright, Principal Licensee of Complete Business Brokers, said it was important for owners to know that the average business sale took about 14 months – some much longer. She said owners should start thinking a few years in advance about what made their business valuable and how they would potentially exit. Ms Wright also said there were some key ongoing discussions business owners should be having with their accountants that could help make and keep their business in saleable condition.

If you want to know how to make your business saleable, take note:

- Stock: These values are commonly discussed at the end of each financial year, however, have you assessed ageing of your stock? Business buyers do not want to take on old stock. Typically, any stock over 12 months old is considered obsolete so it may be best to encourage clients to sell the older stock at reduced prices to ensure stock is rotating.

- Plant & Equipment Values: Potential sellers needed to realise that the sale value of their plant and equipment was not always the same as their tax depreciation schedules. When it came to selling a business, owners needed to be aware of the current secondhand values of plant and equipment. This is critical information required to be able to appraise a business value.

- Private Expenses: Business owners may be tempted to expense private items to reduce profits/tax, but this can be a real negative when it comes to business value. Business owners should be discouraged from trying to expense private items. It makes them vulnerable to a tax audit and is detrimental to the saleable value of the business.

- Business Structure: Does the existing business structure make an arms length purchase relatively easy? Or does some restructuring need to be considered?

- Key People/Relationships: Are there staff members and/or client/supplier relationships that are key to running your business? Can these be transferred as part of a sale process?

- Internal Systems: Are your accounting, stock control and other business systems up to date, efficient, modern and transferrable to new owners?

- Jobkeeper Payments: Some business owners could be holding off on considering a sale until the Jobkeeper payments finish. However, the typical sale process takes at least 14 months – way beyond when Jobkeeper is expected to finish. Therefore, there may still be an argument for starting the sale preparation or listing process.

Ms Wright said that Covid-19 was driving demand, with some people, who had lost their jobs in recent months, now looking to buy a business. For more information about Complete Business Brokers, go to www.completebusinessbrokers.com.au

How to Make Your Business Saleable: Additional Factors

In addition to the points Ms. Wright provided, there are other important factors to consider if you want to know how to make your business saleable.

Growth Potential

How likely your business is to sell can depend largely on how much potential for growth buyers find when analysing your business. Your business is more likely to sell when there is potential to grow and scale. A business that does not provide the potential to grow or develop further offers little to buyers and can even raise red flags.

Over-dependence

If your business has one major client that provides a large chunk of revenue, it can put investors and buyers off. This is because clients can be finicky and prefer to take their business elsewhere when you sell your business, especially if this client prefers dealing with you and does not have an interest in working with the new owners of your business. Multiple ‘big clients’, however, can become a major point of attraction for potential buyers, if they are able to be transferred in the sale of your business.

Accounting Systems

A business’ accounting system is imperative to its success. The accounting system you use can influence a buyer’s decision, as they may be less likely to purchase your business if your accounting system is poor or outdated. Good accounting practice also prevents you from losing financial records, which can also be a deciding factor for potential buyers.

Realistic Expectations

While you manage your business and improve its salability, you should also try to manage your expectations. Often business owners overestimate the true value of their business and get certain values stuck in their mind, creating an expected sell price. If you have a figure in mind for the sell price of your business, you should first ensure that your business is worth it. Buyers look at the historical performance of your business, as well as how it stands at the time of sale, which means you need to properly manage your business’ affairs from the start to ensure no ‘dirty laundry’ is aired later. A healthy, well-managed business can perform better on the market, and you may have more realistic expectations when selling if you know exactly what your business is worth.

To discuss the sale-readiness of your business, or to find out how to make your business saleable, contact or 07 3510 1500.

-

06Jul2020

Virtual Appointments Proving Popular with Our Tax Clients

Virtual Appointments During Tax Time

Tax season has arrived again, and this year, business owners and individuals face a new challenge during tax time: COVID-19. The pandemic has forced us all to restructure our lives and live differently, which is why Affinitas Accounting has been offering virtual appointments to our clients to manage their tax returns and compliance, while maintaining social distancing. Our virtual appointments have proven extremely popular and still retain the same level of dedication and professionalism that our physical appointments offer. Affinitas Accounting’s tax clients are embracing the opportunity to prepare their 2020 tax returns using our virtual and online options – so, if you still require assistance with your tax return or compliance, we can help you through our virtual appointments too!

Virtual Appointments: Online Tax Accounting

Managing your money and minimising your tax burden is not just a technical exercise. It not only reduces unnecessary spending, but it also helps you move forward in your business with confidence. Let us help you manage and maintain your tax accounting and you’ll gain a trusted advisor for your success.

When you work with us, we’ll do the following:

- Reduce your tax each year

- Maximise your investment in your business future

- Optimise spending

- Review your outgoing fees to improve spending efficiency

We understand the pressures that come with running a business, from cashflow to taxation and payroll. That is why we’re here to help you focus on what you do best – running your business. Our experienced and professional online accountants are well adapted to remote working, allowing us to take advantage of streamlined procedures to ensure that your experience with us is nothing shy of excellent. Here’s what you can expect from our virtual appointments:

- Prompt communication

- Advice with your businesses best interests in mind

- Fixed price quotes

- Free phone call enquiries

- A diverse team of highly trained accountants

Our Virtual Appointments: How it Works

Our virtual appointments make managing tax time easier for you. You will receive the same dedicated services that you would if you were able to meet at our Brisbane office.When you book or request a booking for our virtual appointments, you will still be assigned a friendly designated human accountant that will be your contact person. The end result is our services are just the same as traditional appointments. The accuracy, efficiency and reliability of our services are streamlined as our team have adapted to working remotely by creating cutting-edge procedures that save time and reduce the need for in-person communication.

Virtual appointments can be highly beneficial given the advent of social distancing. We utilise the latest technology to ensure that our service remains impeccable for our clients. Our streamlined processes will be saving you a lot of time, money and make running your business much easier during tax season.

Our clients are contacting us, as usual, via phone/email to book their appointment. At this point, we identify whether they prefer a Zoom meeting, phone call or email only service. Our tax checklist is then sent to each client, which we ask to be completed and returned to us within two days to the allotted appointment time. For those who have booked Zoom meetings, these details are also sent via email.

If you want to be quick off the mark with your 2020 tax return, you need to remember that annual PAYG summaries and other details are sometimes not finalised on your ATO portal report until mid-late July. Those who have investments should be aware that the tax details for these are often not finalised until Sept-October each year.

To book your 2020 tax return appointment, contact or phone 07 3510 1500.

-

10Jun2020

5 Top Questions About the HomeBuilder Grant

The phone has been ringing off the hook with questions about the HomeBuilder grant.

Here, I’m focusing on those who want to buy land and build (rather than renovators – that’s a whole separate topic on its own). First, some basics about the HomeBuilder grant:

To qualify for the $25k HomeBuilder grant you must:

- Be Australian citizen

- Earn below $ 125k for singles or $ 200k for couples

- Sign a building contract between 4 June and 31 December (and start the build within 3 months of contract date)

- Be building a home where the value of the completed house and land must be $750k or less

- Own the home in individual names and occupy it as your home. (no investment properties)

The HomeBuilder Grant: Top 5 Questions Answered

The easiest way to explain some of the complexities around the HomeBuilder grant is to jump straight into some of the common questions people are asking.

1. Can I get both the HomeBuilder Grant and the state based First HomeOwners Grant?

As long as you meet the eligibility for each grant independently, you can receive both if you are building your first home.

2. Does this mean that I can get into the market with no deposit?

There are two elements to answering this question. Firstly, meeting the requirements for genuine savings and secondly the timing of when the HomeBuilder grant will be paid.

Let’s take a step back and look at how much you typically need to buy a home.

If you are a first-time homebuyer in Queensland and you qualify for the stamp duty concession, to buy an existing home without the FHOG you would need a deposit of 9% or around $40 000. Of this amount you will need to demonstrate that 5% has been genuinely saved. Neither the FHOG, nor the HomeBuilder grant count as genuine savings.

If you have owned a home before, you would need a deposit of around 10.5 % or around $ 46 300. Again, of this amount you will need to demonstrate that 5% has been genuinely saved.

While the grants may help you reduce the amount you end up borrowing, if you are hoping to get into the market with a new home build with a lower deposit, there are some tricky aspects of how and when the grants are paid that you’ll need to be across and plan for.

Essentially, as with the FHOG, the HomeBuilder grant will not be able to be used as part of your initial deposit.

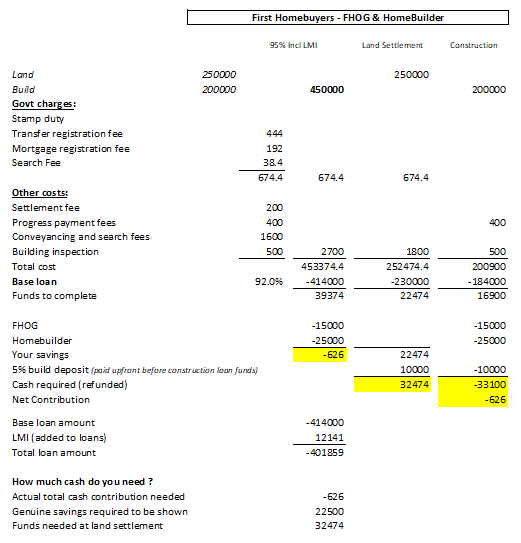

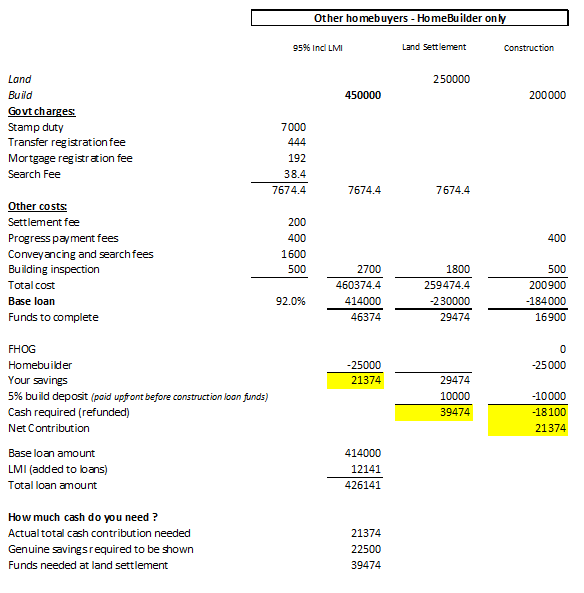

The table sets out what the overall contribution is with a maximum loan of 95% including mortgage insurance, as well as how much is needed at land settlement for both first homebuyers and others. While the actual contribution needed is low, the timing of payments of the grants, and the need to demonstrate genuine savings, means you will actually need a lot more.

3. How do I work out whether I’m under the income cap?

The income cap is the same as the First Home Loan Deposit Scheme, so your income as an individual must be under $125,000 per year and, as a couple, your combined income needs to be under $200,000. This is your gross income before tax (excluding Super). You will be able to find this on your 2019 Notice of Assessment issued by the ATO.

4. If I was under the income cap last year but may go over this year, am I still eligible for the HomeBuilder grant?

The wording of the grant is that the income cap will be based on your individual ‘2018-19 tax return or later’ so if you earned less last year, but will earn more this year, they will use the most recent year to confirm your income.

There is a requirement to report any change in your circumstances to the state revenue office, so the intention appears to be that if you will exceed the income cap before you are paid the grant that you would no longer be eligible.

The HomeBuilder grant may be audited, and if for example you earned $190,000 as a couple in 2018-19 tax year and then earned $220,000 in 2019-20 tax year, you could be required to pay back the grant.

5. What if I am a citizen but my spouse is not?

There are some things we don’t know yet here, as the application form for the HomeBuilder grant Scheme hasn’t yet been issued, so we don’t know the specific questions that will be asked.

However, if it’s going to be similar to the First HomeOwner’s grant, then the eligibility is based on the applicants – which is based on the property ownership.

If this is the case and the property is just in the Australian citizen’s name, you may qualify for the HomeBuilder grant.

Given the uncertainty around what the formal criteria on application will be, I would recommend waiting to see what these are in your state before signing a contract if you need the grant to complete the build. As an industry, we are seeking clarity around Treasury’s intentions here.

You would also need to seek advice here around whether you may meet the criteria to have two people on the loan where only one is on the title (and consider whether this structure is right for you).

I’ll be posting updates as we get more clarity around the ambiguous areas, but in the meantime, if you’d like to understand what this grant might mean for you, reach out at or give me a call on 0430 383 996.

-

10Jun2020

Handy Hints for Tax Time Preparation

Covid-19 Claims

- If you have worked from home due to Covid-19, then the government has announced that it will let taxpayers claim 80c per hour to cover costs of home office expenses, based on documented records of the hours you worked from home. However, if you do not think that this will adequately compensate for what it has actually cost you to work from home, you can choose to assess via a one-month diary establishing your percentage of expenses – mobile phone, home computers, printers, internet and any other costs related to working from home.

Individuals

- Account for all your sources of income during the year, particularly if your have had several jobs or received Centrelink benefits for part of the year.

- Make sure you have receipts for all your work related deductions. Some expenses like union fees can be taken straight from your annual PAYG Summary, but most require their own receipt.

- If you have made tax deductible donations during the year, you will need receipts for these.

- If you use your car for work make sure you have a calculation of how many km you have travelled and if you require a log book make sure it is up to date.

- Any other work related travel expenses will require diarised notes of where and when you travelled, the purpose of the travel and receipts for fares, accommodation and any other expenses.

- Did you purchase any uniform or protective clothing for work purposes?

- Did you undertake any study that was directly related to your work activities?

- If you studied or worked from home, how many hours per week?

- If you were required to use your personal internet or mobile phone, have you made an effort to establish the percentage usage for work?

- You will need details of any earnings from bank interest, share dividends and managed funds.

- If you sold any investments you will need both purchase and sales details if there is a capital gains calculation to be completed.

- Have you checked your insurances to see if they include tax deductible income protection premiums?

Small Business Owners

- Many of the hints for individuals are transferrable to small business owners. However, there are some specific reminders that may apply to business owners.

- Have you reviewed your debtors to see if there are any bad debts to be written off?

- Do you have any obsolete stock or equipment that can be written off prior to 30 June?

- Are all your staff obligations for PAYG Tax and Superannuation up to date?

- Have you disposed of any capital equipment or bought any new equipment?

- Is any of the new equipment worth less than $150,000 and available for immediate write-off?

- Have you sat down and completed a tax planning exercise to in the past quarter?

Investment Property Owners

- Ask for an annual statement of income and expenses from your rental property manager

- Account for all the expenses paid directly by you in relation to the property – usually rates, water, body corp, insurance and some repairs.

- Have you checked whether you have a current depreciation schedule for the property.