The Australian Federal Government delivered a substantially increased package available for individuals and small businesses yesterday to ease the economic downturn from the Coronavirus pandemic.

Affinitas Accounting is a member of professional associations, thought leadership groups and specialist private forums.

There have been numerous discussions across all of these as to the interpretation of how these measures will be applied. The consensus, with which we agree, is to read the legislation, before advising any on any specific strategies.

Please do feel free to reach out with any questions that you may have, and we will release updates as soon as we have more information to share.

In Summary

Individuals

- Early release of superannuation – individuals in financial distress may be able to access up to $10,000 of their superannuation in 2019-20, and a further $10,000 in 2020-21. The withdrawals will be tax-free and will not affect Centrelink or Veterans’ Affairs payments.

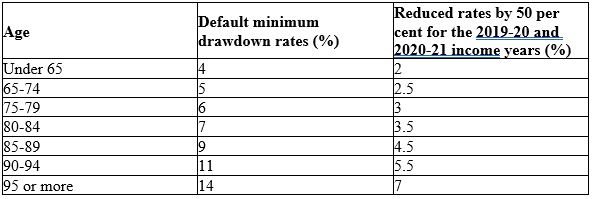

- Temporary reduction in minimum superannuation drawdown rates – superannuation minimum drawdown requirements for account-based pensions and similar products reduced by 50% in 2019-20 and 2020-21.

- Deeming rates reduced – from 1 May, superannuation deeming rates reduced further to a lower rate of 0.25% and upper rate of 2.25%.

Supplements increased, access extended and eased – for 6 months from 27 April 2020:

- A temporary coronavirus supplement of $550 will be paid to existing income support recipients (people will receive their normal payment plus $550 each fortnight for 6 months).

- A second one-off stimulus payment of $750 will be paid automatically from 13 June 2020 to certain income support recipients (in addition to the payment made from 31 March 2020).

- Eligibility for access to income support eased to include sole traders and the self-employed, and to those caring for someone infected or in isolation.

- Waiting periods and assets tests temporarily waived.

Bankruptcy safety net – temporary 6-month increase to the threshold for the minimum amount of debt required for a creditor to initiate bankruptcy proceedings against a debtor from $5,000 to $20,000.

The Government has flagged that additional stimulus packages will be required.

Sole traders and self-employed eligible for Jobseeker payment

The eligibility criteria to access income support payments will be relaxed to enable the self-employed and sole traders whose income has been reduced, to access support.

Individuals

Early release of superannuation

From mid-April, individuals in financial distress may be able to access up to $10,000 of their superannuation in 2019-20 and a further $10,000 in 2020-21. The withdrawals will be tax-free and will not affect Centrelink or Veterans’ Affairs payments.

To be eligible to access your superannuation you need to meet one or more of the following requirements:

- you are unemployed; or

- you are eligible to receive a job seeker payment, youth allowance for jobseekers, parenting payment (which includes the single and partnered payments), special benefit or farm household allowance; or

- on or after 1 January 2020

- you were made redundant; or

- your working hours were reduced by 20% or more; or

- if you are a sole trader — your business was suspended or there was a reduction in your turnover of 20% or more.

For those eligible to access their superannuation, you can apply directly to the ATO through themyGov website from mid-April.

Temporary reduction in minimum superannuation drawdown rates

Superannuation minimum drawdown requirements for account-based pensions and similar products will be reduced by 50% in 2019-20 and 2020-21.

The upper and lower social security deeming rates will be reduced further. As of 1 May 2020, the upper deeming rate will be 2.25% and the lower deeming rate of 0.25%.

Time-limited fortnightly $550 ‘coronavirus supplement’

For the next 6 months, the Government is introducing a new Coronavirus supplement to be paid at a rate of $550 per fortnight. This supplement will be paid to both existing and new recipients in the eligible payment categories.

The payment will be made to those receiving:

- Jobseeker payment (and those transitioning to the jobseeker payment)

- Youth allowance jobseeker

- Parenting payment

- Farm household allowance

- Special benefits recipients

Also, eligibility to income support payments will be expanded to:

- Permanent employees who are stood down or lose their job

- Casual workers

- Sole traders

- The self-employed

- Contract workers who meet the income test

The Government notes that these criteria could include those required to care for someone affected by the Coronavirus. Asset testing has also been reduced and will be waived for 6 months. Income testing will still apply.

The payment is not available if you have access to any employer entitlements such as annual or sick leave or income protection insurance.

Second $750 payment to households

The Government is now providing two separate $750 payments to social security, veteran and other income support recipients and eligible concession card holders residing in Australia (see the full list here). The payment will be exempt from taxation and will not count as income for Social Security, Farm Household Allowance and Veteran payments.

Payment 1 from 31 March 2020 (previously announced on 12 March): Available to people who are eligible payment recipients and concession cardholders at any time between 12 March 2020 to 13 April 2020;

Payment 2 from 13 July 2020: Available to people who are eligible payment recipients and concession card holders on 10 July 2020.

The payments will be made automatically to those that meet the criteria.

Bankruptcy safety net

A temporary 6-month increase to the threshold for the minimum amount of debt required for a creditor to initiate bankruptcy proceedings against a debtor will increase from $5,000 to $20,000. Also, the time a debtor has to respond to a bankruptcy notice will be temporarily increased from 21 days to six months.

Where someone declares their intention to enter voluntary bankruptcy, the period of protection from unsecured creditors will be extended from 21 days to 6 months.

More information: