-

10May2019

Add Value at Tax Planning Time

The months of May and June are always busy times in the world of tax and accounting.

Not only are we finishing the last of our tax returns for the 2018 financial year, but we are tax planning with clients for the 2019 tax year.

Why Is Tax Planning Important?

It provides each business the opportunity to assess their potential tax situation PRIOR to 30 June each year. This gives a business time to either plan for the expected result and/or implement legal strategies to reduce their tax. Finding out you have a larger-than expected tax bill after 30 June is too late – because there is nothing you can do to reduce it.

How Does The Tax Planning Process Work?

By early May, we should have your business results up until 31 March – the end of the third quarter. Based on these figures, we can usually project your annual profit with a fair degree of accuracy. To do this we consider historical data from previous years, plus an estimate from the business owner/s of their projected last quarter results. And we do not just consider the figures in the business entities, but we include how that profit will potentially flow through to other entities or onto individual tax returns.

Uncovering Tax Opportunities

Sometimes there are opportunities within the business to reduce your taxable income. These can include pre-paying expenses; writing off bad debts, or obsolete stock and equipment, or contributing extra into superannuation for company directors. The immediate write-off of business assets up to $30,000 also could be useful to pick up new assets needed by the business and claim a full tax deduction prior to 30 June.

Broader Value Of Reviewing Your Numbers

Smart business owners will take the time to stop and assess how their business is travelling as year end nears. How do the figures compare with previous years? Are there any line items in the accounts that tell a story? For example, has any particular source of income greatly increased or decreased? Have expenses like wages or cost of goods sold increased and reduced your profitability? What about the balance sheet? Is your cash position getting low? Are trade debtors or trade creditors increasing? Are your tax debts or long term liabilities increasing? Picking up on trends in your numbers – good or bad – can help you put plans in place and set a strategic direction to navigate your business in the right direction.

Front Foot Business Review

This end of year process can be taken even one step further, via a formal business review. Called a Front Foot Business Review, we run through a comprehensive checklist with management, designed to check whether the operational, strategic, marketing, risk, insurances, partnership/directors agreements, leases and succession plans are in place and current. This review almost always highlights at least one or two areas that require work to be done.

To ensure you are making the most out of the 2018-2019 tax planning season, contact us on or phone 07 3510 1500.

-

03May2019

Taxing times as voters weigh up election options

On Saturday, May 18, Australians will vote to choose the our next Federal Government.

At every Federal poll there are many different candidates with many different policies – but ultimately all policies need to be paid for – and the vast majority of that money comes from taxes collected by the ATO.

This election contains proposed changes to tax law from various parties that could have a significant impact on investors, small business owners and salary and wage earners alike.

It is not our intention (or our place) to suggest any particular strategy with regards to your voting. However, as professionals in tax and accounting, we felt that our clients and other followers may find the table below a useful summary of the key tax issues and impacts of the policies being supported by three of the parties likely to have a major say in the election outcome.

We have included links to articles that explain each issue in more detail, as they are currently available. We encourage you to read up on these and engage in conversations with your current local member, or those contesting the seat in your local electorate.

And yes, we acknowledge there are other parties, such as the United Australia Party and One Nation, who also have published tax policies. These can be found via a quick Google search – and we encourage you to do so if you are interested.

We have seen many times over the past three decades that what is promised during an election campaign and the final legislation passed can be very different. But it still helps if you can head into the voting booth with a working knowledge of what each party is promising AND how they intend to pay for those promises. Always remember, it is YOUR money they are collecting and spending.

Liberal

Labor

Greens

Negative Gearing

No change

Limit negative gearing to new housing

from 1 Jan 2020. Any investments made prior to the changes will not be affected.

If you buy an established house as a rental property or borrow to invest in shares (as examples) and your expenses are more then your income, from 1 Jan 2020 you will not be able to use those losses to offset any of your other income.

https://www.alp.org.au/negativegearing

Remove all negative

gearing for property investors

CGT Discount

No change

Reduce the capital gains discount for assets held longer then 12 months to 25% from 1 Jan 2020. (currently 50%)

This could increase the tax you pay on not only investment property sales but also share, business and other investments sales that make a capital gain.

Remove all CGT concessions for property investors

Franking Credit

No change

Making franking credits a non-refundable offset, proposed to come in to effect 1 July 19. Their pensioner guarantee sees pensions protected from these changes as well as pre-existing self-managed super funds.

While franking credit can still be used to reduce tax payable, no cash refunds for unused franking credits will be given. This means dividends would be taxed at the individuals nominal tax rate.

https://www.chrisbowen.net/issues/labors-dividend-imputation-policy/

No change

Small Business deductions

Instant asset write-off of $25,000 will apply until 30 June 2020

Immediate 20% deductions for eligible business assets (currently 15%)

No change

Deduction for managing tax affairs

No change

Limiting deductions on managing tax expenses to $3,000 per individual per year.

No change

Super deduction for individuals

No change

Remove the recent changes made to deductibility for personal super contributions & catch-up concessional contributions

No change

Taxation of trusts

No change

Put a minimum 30% tax on distributions made to adults from discretionary trusts

No change

Non-Concessional contributions & Division 293

No change to current cap

Lowering annual cap to $75,000 (currently $100,000) and Reducing threshold to $200,000 (currently $250,000)

No change

Tax Rates

Doubling the low and middle-income tax offset to $1,080, raise the threshold for the 19% tax rate from $41,000 to $45,000 in July 2022 and flatten tax brackets so everyone earning between $40,000 to $200,000 pays a marginal rate of 30% from 2024.

Doubling the low and middle-income tax offset to $1,080 and increase tax cuts for people earning less then $48,000, including a $350 tax cut for workers earning up to $37,000.

Increasing the top individual rate from 45% to 49% for earnings over $180,000

https://www.alp.org.au/tax_refund_for_working_australians

Doubling the low and middle-income tax offset to $1,080. Repealing the income tax cuts from 2018 & reintroducing the deficit levy permanently, increasing the tax rate of a person earning more then $180,000 by 2%. Increasing company tax rate to 30% for businesses earning more then $10m a year.

Useful links comparing tax policies

Contact us if you have any questions about how these policies apply to you and your tax planning.

-

26Apr2019

What Should You Be Doing To Get Ahead While Interest Rates Are Low?

In the last blog in this series, we looked at the difference you can make to the cost of your mortgage by ensuring that you’re not paying over the odds on rate, as well as some of the complexities around rate that need to be considered when refinancing.

Here I’m looking at how you can set up some healthy financial habits that will not only reduce finance related stress and smooth your cash flow, but also save you thousands on interest and years off your mortgage.

Each time you look at your mortgage, this involves looking at your family budget. While this doesn’t usually top the list of the way we like to spend our time, there is an upside to the exercise if we can leverage it to your advantage . It often presents an opportunity to better manage cash flows and through this it can make a huge difference to your bottom line, especially if the changes can be automated.

There are a few categories of savings that make sense for everyone to have:

- Emergency savings – depending on your age and commitments a good target is somewhere between 3 and 6 months net income. How much you need in this category to feel secure will also depend on your personal risk profile and how easily you might be able to replace your income through finding a new role in the event of retrenchment etc. These should be funds that you don’t dip into for anything else.

- Cash flow savings – these are funds set aside from each pay check to cover expenses that you know are coming, but are paid less frequently than your pay cycle. These could include quarterly bills like rates, body corporate fees, electricity etc. There are simple ways to work out how much you should be setting aside that don’t involve a weekend of wading through bills.

- Home loan repayment savings – by calculating what your home loan repayment would be if rates went up by even just 1% and setting the difference aside, you’ll not only have a buffer in place if rates do rise but you’ll also have the benefit of extra savings on your mortgage that increase at a compounding rate each month.

- Fun – Savings for holidays or family adventures and activities that cost more than you can cover in any given month. Some of these savings may go towards extra expenses at Christmas etc, these could also be savings towards that trip of a lifetime.

A real life example:

It’s often easier to see how powerful these strategies can be by looking at a real life example. Let’s take a young family with two kids on a reasonably tight budget. After tax, their total family income is $80 000 a year.

Their goal is to have emergency savings of 3 months net income, or $20 000. As they have recently bought their first home and then had their second child, their savings aren’t substantial. They’ve set a target to work towards having their emergency savings in place over 3 years, so they’re saving $ 500 per month towards this.

Their living expenses each month are around $4000 per month, excluding their mortgage. Of this around $1250 are bills like electricity, rates, school fees, rego and insurance that are paid quarterly or annually. The balance of $2250 includes general living expenses and a monthly fun budget.

They are setting aside $400 per month towards family holidays and extra expenses over Christmas time and birthdays.

Their home loan is the same one we calculated savings on in the previous blog — $ 400 000 where we reduced the rate from 4.25% to 3.95%. They kept their repayments the same even though their rate dropped, so they’re already part of the way there on the changes they need to make to ramp up their home loan repayment savings.

Their home loan repayment savings are set at repayments at 4.95% less their actual minimum repayment at 3.95%. On their $400 000 mortgage, this equates to $ 236 per month in addition to their mortgage repayment of $1900pm.

To see how this works for them, let’s look at where they are at the end of the first year, and then at the end of year 3.

At the end of 12 months, their savings balances are :

Emergency savings $ 6000

Cash flow savings $ 3125 (approx. 2.5 months of monthly amount saved as expenses are paid from these savings)

Fun savings $ 1600 (assuming around 2/3 of the fun savings used and the rest saved towards longer term adventures)

Home loan savings $ 2832

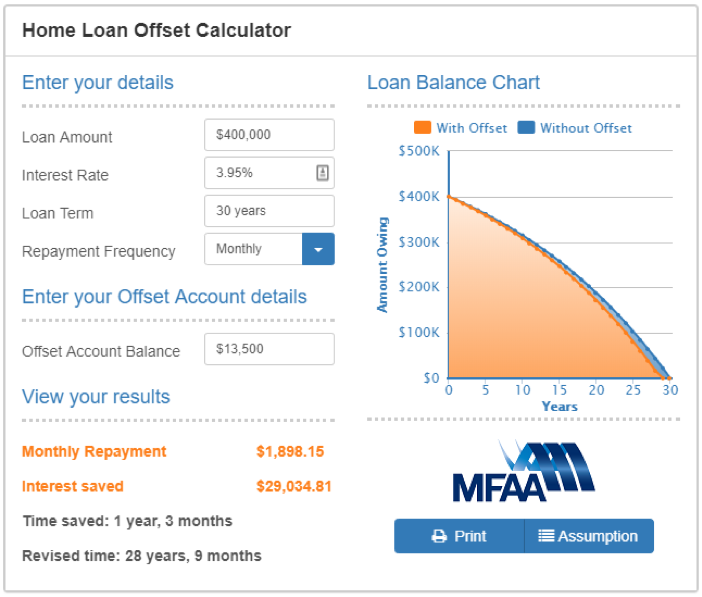

Total savings $ 13557

In year 2, they’ll save around $533 in interest (on their $ 13 500 saved) but over the life of the loan, with no further savings, this would be savings of almost $30 000 in interest and a little over a year off their mortgage.

Let’s roll this forward for another 24 months assuming they continue to add to their savings:

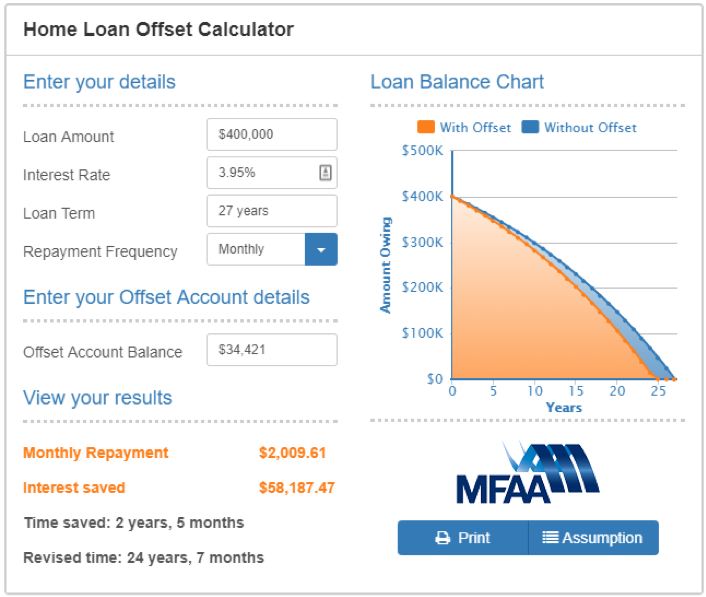

Emergency savings $ 18000 ( 36 months at 500 per month)

Cash flow savings $ 3125 (average balance)

Fun savings $ 4800

Home loan savings $ 8496

Total savings held $ 34421

At only 3 years in, if they did nothing more (and maintained this level of savings) they would save $ 58187 in interest and 2.5 years off the mortgage over the life of the loan.

Not only have this family achieved their peace of mind goals of having 3 months income set aside for emergencies, they now have a buffer in place to protect them in the event that interest rates rise. On top of that they’re on their way towards their goal of a fabulous family holiday adventure.

At this stage, happy with the level of their emergency savings, they could split the $500 per month and add half to the home loan repayment savings and half to fun savings, ramping up their financial goals and their fun!

By spending a little extra time upfront getting advice on a personally tailored home loan strategy supported by the right structure, and an automated savings plan set up with their loan, they’re achieving all these goals and saving almost $ 60 000 in interest and 2 and a half years off their mortgage.

If you’d like to see how powerful keeping your savings in offset could be on your mortgage, visit my website at www.affinitasfinance.com.au/calculators/

If you’d like to chat about a personalised strategy, get in touch on 0430 383 996 or .

This article was originally published on Affinitas Finance.

-

12Apr2019

Instant Asset Tax Write Off Increased to $30, 000 — Effective Now

Tax planning opportunity via asset write-off increase

The biggest potential tax bonus for small business in the 2019 Federal Budget was the announcement that the instant asset write-off had been increased and offered to more businesses.

The instant asset write-off threshold for small businesses (with an aggregated turnover of less than $10m) will be increased to $30,000 for eligible assets that are first used, or installed ready for use, from 7.30 pm (AEDT) on 2 April 2019 (Budget night).

The extension is until 30 June 2020 – but qualifying businesses have between now and 30 June 2019 to purchase and fully deduct eligible assets up to the $30,000 threshold in this tax year.

This could be mean office equipment, machinery and even motor vehicles can potentially be upgraded between now and 30 June 2019 and be 100% tax deductible.

The original threshold of $20,000 already had been increased to $25,000 from 29 January 2019 for businesses with turnover up to $10m. But from Budget night, the new $30,000 immediate write-off threshold applied to all businesses with an aggregated turnover up to $50m.

To claim the write-off, items purchased must be first used or installed ready for use by the appropriate cut off date – either 30 June 2019 or 30 June 2020.

The new qualifiers, medium sized businesses (with aggregated annual turnover of $10m or more, but less than $50m) only qualify from Budget night.

The current rules general rules regarding accelerated depreciation for small businesses will remain in place. Therefore, assets that cannot be immediately deducted will need to be pooled and depreciated at an initial rate of 15% in the first year and 30% in each subsequent year.

However, small business depreciation pools valued under the instant asset write-off threshold at the end of the income year can be immediately deducted. The current “lock out” laws for simplified depreciation rules, which prevent small businesses from re-entering the pooling rules for five years if they opt out, will continue to be suspended until 30 June 2020.

Medium sized businesses do not have access to the small business pooling rules and will instead continue to depreciate assets costing $30,000 or more (which cannot be immediately deducted) in accordance with the existing depreciating asset provisions in the tax law.

Overall, it’s good news and a great tax planning opportunity that you should discuss with your accountant between now and 30 June as part of your annual business review.

-

05Apr2019

Affinitas Hails A New Service Champion

At Affinitas, it has never been our goal for clients to be merely satisfied with our service.

We want them to be AMAZED with what we offer, BLOWN AWAY with how we offer it and RAVING FANS of the overall experience of being an Affinitas client.

To underline our commitment to this ethos, Affinitas has appointed a Client Service Champion.

Affinitas Accounting partner Tanya du Preez has been appointed to this role. Tanya is a trained and qualified accountant, but her day-to-day speciality is finance rather than working in the tax team.

Sitting outside the tax/accounting team puts Tanya in an ideal position to give clients an outlet to discuss their experience as an Affinitas client.

Tanya sees her role as being responsible for making sure the Affinitas team delivers more than just professional advice and timely service.

“We believe you also deserve an amazing experience as part of the package in dealing with us,” Tanya says.

“We all love to hear when we’ve done things well, but we improve by hearing what we could do better.”

“Our team culture around feedback is a really positive one, so please feel free to tell us what you think, especially if we have dropped the ball in any way.”

Ensuring clients are aware of the full range of services that Affinitas offers, and accessing the ones they need, will also be an important part of Tanya’s role as our Client Services champion.

Affinitas clients – old and new – will all receive a welcome letter from Tanya to officially introduce herself in her new role.

There will be structured feedback opportunities, such as surveys, provided at the conclusion of various services to give clients an opportunity to provide feedback on their experience.

In addition, clients are welcome to contact Tanya any time on or by phoning the office on (07) 3510 1500. For urgent calls, Tanya can be reached on 0430 383 996.

-

29Mar2019

How Does Depreciation Add Value To A Rental Property?

Professionally prepared depreciation schedules are one of the keys to getting the best from your investment property tax benefits.

Many clients initially baulk when we suggest they spend the money to get a depreciation report prepared – but in most cases they pay for themselves many times over during the life of your investment property, because of the extra deductions they allow.

And importantly, they are deductions that do not require any extra cashflow once the report is prepared.

The following are some of the most frequently asked depreciation questions – answered by the experts at BMT Tax Depreciation.

What is depreciation?

As a building gets older and items within it wear out, they lose value. The Australian Taxation Office (ATO) allows property investors to claim a deduction relating to the building and fixtures it contains. Depreciation can be claimed by any owner of an income producing property. This deduction essentially reduces the investment property owner’s taxable income.

What is a depreciation schedule?

A depreciation schedule is a comprehensive report that outlines the depreciation deductions claimable by investment property owners on the property’s building structure and its fixtures and fittings within it.

A depreciation schedule, prepared by a specialist Quantity Surveying firm, is one of the best ways that you can maximise the cash return from your investment property each financial year.

If a residential property was built before 1987 is it too old?

No, investment properties do not have to be new. Both new and old properties will attract some depreciation deductions. It is a common myth that older properties will attract no claim. Previous year’s tax returns also can be adjusted. If a property owner has not maximised their depreciation deductions, the ATO allows investors to adjust the previous two financial years tax returns.

How is a building’s age calculated?

The age of the building can be determined by obtaining council documents with dates pertaining to the original application approval date or the occupancy certificate date and final inspection date.

A quantity surveyor will conduct the relevant searches to accurately determine the age of a building. This includes historical council searches regarding lodged development applications, as well as occupancy certificates and certified final inspections.

What is the difference between plant and equipment and capital works?

Plant and equipment (division 40) assets are items that can be ‘easily’ removed from the property, as opposed to items that are permanently fixed to the structure of the building.

Plant and equipment assets also include electronically or mechanically operated items, even though they may be fixed to the structure of the building.

Plant and equipment assets include, but are not limited to:

Carpets

Hot water systems

Ovens

Blinds

Rangehoods

Cook tops

Door closers

Garage door motors

Freestanding furniture

Air conditioning systems

Capital works (division 43) is based on the historical construction costs of the building and includes such items as bricks, mortar, walls, flooring and wiring.

Why does the depreciation schedule last 40 years?

The ATO has determined that any building eligible to claim the building write-off allowance has a maximum effective life of 40 years from the date construction was completed. The owner can generally claim up to forty years depreciation on a brand new building, whereas the balance of the 40 year period is claimable on an older property.

Can the building owner claim renovations that were completed by a previous owner?

Yes. Anything in the property that is part of a previous renovation will be estimated by Quantity Surveyors and deductions calculated accordingly. This includes items which may not be so obvious, for example, new plumbing, waterproofing and electrical wiring. For capital works improvements to qualify for the division 43 building write-off, they must have commenced construction within the qualifying dates.

How long will it take to get my schedule?

Once a professional Quantity Surveying Firm, such as BMT, have collected all of the details needed, it usually takes between five – seven days for our team to prepare a schedule.

Is your property inspected?

A professional quantity surveyor should inspect all properties that a tax depreciation schedule is to be completed on. This ensures that all assets are identified and depreciation deductions maximised. This also ensures schedules are fully compliant with the guidelines set out by the Australian Institute of Quantity Surveyors (AIQS), the Royal Institute of Chartered Surveyors (RICS) and, importantly, are ATO compliant.

Doesn’t my accountant take care of this?

Professional Quantity Surveyors will work with your accountant to ensure that your depreciation claim is maximised each financial year for your investment property. The ATO has stated that Quantity Surveyors are one of the only recognised professions with the appropriate construction costing skills to estimate construction costs for depreciation purposes. Quantity Surveyors are qualified under the tax ruling TR97/25 to estimate construction costs for depreciation purposes and are one of a few select professionals who specialise in providing depreciation schedules.

What happens when renovations are undertaken after the report is finished?

If you make additions to the property after you receive your depreciation schedule, your depreciation schedule can be updated – either free or usually at a discounted price for any changes.

Source: Beer, Bradley (B Con Mgt, AAIQS, MRICS, AVAA), CEO BMT Tax Depreciation.

BMT Contact details: 1300 728 726 or website www.bmtqs.com.auLearn more about rental property investing courtesy of Affinitas here.

-

19Mar2019

Who Are Total Water Services?

Last week, Brad sat down with the team at Darren, Peter, and Craig from Total Water Services to chat about how we work with them to deliver effective, explained accounting. We help them understand their numbers and make sure they know exactly how their business growing. Find the transcript for this interview below:

—

Brad: As part of our ongoing series chatting with Affinitas clients, we have the pleasure this morning of talking to the senior management team from Total Water Services. Total Water Services is a diverse and quite a large plumbing, and water reticulation business based in Hillcrest in Brisbane, and this morning, we’ve got the three directors with us, Darren, Peter and Craig. Welcome, boys.

Brad: As I mentioned in the introduction, you have some specific areas of expertise and different income streams in the business. Darren, can you tell us a little bit about the area of specialty that you look after?

Darren: In my past, working career, I’ve worked for a lot of major pump manufacturers. I’ve learnt a lot of pumping and stuff, so we pushed a lot into that area. But I also spent a lot of time with the commercial nurseries in the market. And we specialize in disinfection and different parts of that market.

Brad: And that’s a growing part of business in certain parts of South Brisbane?

Darren: It has been in the last 5 years, and in the last 5 years it’s grown quite quickly. Mainly because of the amount of developments that have gone through South East Queensland at the moment. So the plant requirement is going through the roof, so obviously the nurseries have grown with it.

Brad: Peter, you look after the really big projects, the quoting and running of those projects. How does that area work?

Peter: We do all these larger projects, we do all the irrigation, we do plumbing and drainage works, so that’s an immense amount of time, and high value of course which is good for the business in the long term.

Brad: And Craig, you’re involved heavily in the service side of the business. How has that been going and growing for you?

Craig: In the past 11 years, since we’ve started, we’ve focused on servicing the customer, hence the name Total Water Services. But we’ve also broadened our scope by looking at the service side, by assisting the local plumbing network. That’s around Brisbane, Gulf coast and North coast areas. We specialize in servicing sewer, storm water and portable pump water stations. Which gives us, pretty much a broad scope throughout the city and metro areas. We also service right down to the small domestic services.

Craig: So, in the past years, we have found it quite fruitful. We now have a great range of family clientele. And we’re also specializing in pump modifications, so full we fit programs as well as going into mild factory based work. And offering solutions in not only water, but in chemical and other emulsion.

Brad: So, yeah as we can see there, you’ve got three very distinct areas of expertise and income strings there. But on top of that you also run the store here out of Hillcrest, and that’s a supply store to the plumbing industry. And that’s been growing over the past few years as well.

Craig: It’s been a long time in the making, our biggest hurdle that we had … was getting our clientele to know that we actually existed. We embarked on many different advertising campaigns; word of mouth in the very beginning was a very strong arm for us, and now what we find is the flow through traffic for the store is actually quite good … but this store was actually designed by the customer for the customer.

Craig: So we took the input of our local clients, we took the input of local businesses that required equipment … and we basically formed and stocked the store to suit.

Brad: And you finding a lot of businesses here?

Craig: Yes, a lot of repeat business. Especially now that we in the 11th, well the 12th year now. We finding now repeat business is actually quite good. But the bigger thing is the actual new business.

Brad: So, when we first met you, we were online tax and now we are Affinitas … you were already in business and running a business. So the decision to change accountants was an important one, and not an easy one to make. How did you find us, and how were you able to feel comfortable about making the decision to change accounting firms?

Darren: It’s really a word of mouth thing that … another supplier that we dealt with in the past, and he said, “Hey these guys are pretty good,” and we were looking for someone at the time. We found that our account at that stage wasn’t quite up to the market of our size business. We were growing beyond his capabilities, in our own opinion, so we thought we needed someone who had a little bit more expertise. And you so definitely fitted the bill of that.

Brad: At the end of the day, you had to hear our pitch as accounting firms; what we offered … and then decide just exactly what you wanted to do as far as changing accounting firms. So what was the thing that tipped you over the edge to say “Yes we will change accounting firms”?

Craig: Diversity! Diversity was the key. We’re always under the belief that we could … well stepping back we went back, we had multiple different agents helping us out through our business type. And what we found, and the three of us, were under the belief that we could tie our legal services, our accountancy services, our brokerage services; under one banner. Which was a single point of contact and at that point in time when we were searching, we came across this personal supplier that said “Hey, look, give this Brad a ring”. And that’s how it actually started, and the whole reason that we really wanted to move on, again like Darren said, we had quite an extensive growth rate, and we were finding it hard to manage.

Craig: Because we specialize in what we do. But we are not accountants, we’re not a legal team, and we’re not real estate agents. So, we needed to acquire the services, but we wanted to do it in one banner. And that’s where the key for Affinitas or pre on one actually started.

Brad: How have you found the communication between us as accountants, and you as business owners, has worked in your favor over the years?

Peter: It has been very good actually. Particularly with the people in your office, and our own admin people. They formed good relationships, and they actually talk to each other more than we even know, which is good, because they give us [inaudible 00:06:57].

Brad: A broader question Peter, what do you see as the future of the plumbing industry, in South East Queensland?

Peter: I think, there’s definitely a future. And for us, we’re only 12 years old. We’re in that twelfth year, so I see a lot of growth yet to come. We’re in a few different industries, but they all sort of relate back to plumbing. But our focus is probably the irrigation pumping. The plumbing just happen to tag along with us. We have a shop, we have a lot of plumbers come in and purchase products, so we’re able to give them that expertise.

Peter: So that’s side of it is growing.

Brad: As long term business owners yourselves, how would you advise other plumbing firms to choose the right kind of accounting firm for their needs?

Darren: You do need a company that will actually look after you, so that they can look after that part of the business. You find that people within our industry of plumbing and irrigation as well, is that we really don’t know much about accounting. We can work at offloading, we can do our sales, we can do our design. But that back end of the business, which is obviously the most important part of the business, we don’t have a lot of knowledge on that. So you need to instigate someone that has it.

Brad: And I think one of the important things that we do, is when we have our annual meetings; we look at explaining the numbers to all three of you, and give you options of how tax planning and cash flows might work. And I think you found that a very valuable service.

Craig: It’s a key thing, that the forward thought has really helped our business … to a point where, even though we hit a couple of stumbling stones, we have the ability to acquire the premises, which has really helped our business behind the scenes as well. So, getting back to it, we need a team who has the ability to take us from not only basic accountancy, start a relationship, but to cover all facets.

Brad: Thank you very much boys! It’s been a pleasure chatting to you officially, as part of our series. And I know the three of you are very busy, so you need to get out and go to work, so thank you very much for being involved. And we look forward to bigger and better things.

—

Find out more about how Affinitas can help your plumbing business here.

-

08Mar2019

How To Avoid Superannuation Troubles As An Employer

It’s official and serious!

New laws introducing penalties, including imprisonment up to 12 months, for non-compliance of superannuation guarantee obligations have been passed.

Earlier this month, Jotham Lian, in the Accountants Daily newsletter, reported that new legislation now allows the ATO commissioner to issue a direction to an employer to pay an outstanding super guarantee liability.

Failure to comply with this direction can result in criminal penalties.

The maximum penalty for the offence is 50 penalty units, imprisonment for 12 months, or both.

Plus, employers who receive direction from the commissioner must complete an approved education course.

The new legislation is awaiting Royal Assent, with the legislation to take effect from 1 April 2019, but will apply to SGC obligations arising from 1 July 2018.

This makes it vitally important that FROM NOW all directors, each quarter, ensure their business superannuation obligations have been accurately calculated and are paid on time. And if your accountant is not involved in calculating your super obligations, then it may be worthwhile having a conversation with them to ensure your super compliance systems are in order. Your accountant may be able to suggest solutions, like introducing a single touch payroll, to ease the compliance burden.

Accountants Daily RSM senior manager Tracey Dunn was reported in Lian’s article as saying that the new law might catch out small to medium-sized family businesses where a spouse or family member may be appointed as director without fully understanding their obligations regarding super payments.

“Obviously the criminal penalties will only apply to serious cases, but unfortunately in a lot of small businesses super guarantee payment are the first thing that goes (unpaid) and they are quite often behind because of cashflow issues so there will be a higher risk,” Ms Dunn said.

“For example, a husband runs a business and he is the brains of the business but the wife will be put in a position where she is a director. The accountant may discuss the director obligations with the husband but then rely on the husband to relay that to the wife and she may not ever fully understand what her risk is.

“They (the wives) now face a criminal penalty if, within a business, those compulsory superannuation guarantee payments aren’t made on time.”

Ms Dunn said she believed accountants had an important role to play in helping clients their clients understand the new risks.

“Accountants and advisers really need to ensure that when their clients employ staff, they are fully aware of the risk of non-compliance with super guarantee obligations,” she said.

Latest data from the ATO estimates unpaid super guarantee at $2.79 billion and these measures are a clear indication the Government is extremely serious about ensuring all employees receive their superannuation entitlements.

Acknowledgement: ; Accountants Daily, 1 March 2019.

Acknowledgement: ; Accountants Daily, 1 March 2019. -

28Feb2019

How You Could Save Money Outsourcing Your Accounting

As your business grows, one of the most important areas will be your accounting and finance team.

Although hiring an in-house accountant is a common choice, it may not be the best option for your company. This is especially true when you consider that technology now allows many tasks to be done remotely, at any time and any place.

Here are three reasons to consider outsourcing your accounting work rather than keeping the job in-house:

Outsourcing May Actually Cost Less

Let’s look at a scenario where a company is considering, via a recruitment agency, hiring a young accounting graduate, with 2-3 years of experience, for $50,000 per year base salary.

But what is the real cost of that employee? The table below discusses the many additional costs associated with an in-house employee.

Base Salary: $50,000

Superannuation (9.5%): $4750

Recruitment Fee (16%): $8000

Annual Leave (4wks): $3846

Sick Leave (10days): $1370

Training/Education: $2000

Office Space ($500/mth): $6000

Computer/Equipment $4000

Misc (Food/Supplies etc) $1500

TOTAL: $81,466

As you can see, hiring an in-house employee for your company can cost you up to $30,000 more per year above the base salary.

Plus there are all the workplace health & safety and HR aspects of managing employees.

By outsourcing, all you pay for is the work—nothing else. And ask yourself – would outsourcing the work cost you as much as $80,000? It is at least worth considering outsourcing as an alternative.

Outsourcing Provides Continuity

If accounting is not your core business, what happens when your ideal young accountant decides to leave? Do you stop working on the core activities of your business to recruit and then train a new young accountant?

It may take weeks (or even months) to hire someone else and you will have to train them. What sort of effect is this going to have on your operations? How long is it going to take your new employee to be as competent in their role and familiar with your clients as their predecessor?

By outsourcing, the burden moves from you to the contractor. The majority of outsourcing companies will have more than one employee working on your job. So, if one of their employees quits, they have others who are equally as comfortable with your needs to fill in and take their place. Their work papers and other systems will ensure the knowledge of your company’s needs will not disappear with a departing employee.

Outsourcing Keeps You Competitive

Let’s say you are lucky enough to keep an employee with you for 10-plus years. Sounds great, right? Maybe not.

Although you have avoided employee turnover, you’ve potentially created an entirely different problem.

The accounting employee who has stayed in the same job for more than decade, will almost certainly have a very set way of doing things. And because accounting is not your core business, they receive no exposure to the way technology and processes have evolved – and thus your business might be missing out on the positive effect these changes could have to your bottom line. By not keeping up with a forever-evolving business world, you may sacrifice your company’s ability to remain competitive.

Any worthwhile specialist contractor will see a wide array of businesses and stay up-to-date in their field through continuing education and conferences.

Are you ready to outsource?

While a good accounting and finance team is essential to the long term health of any successful business, technology has provided many options for how these services can be implemented into your business.

If you are considering, or have always chosen, the traditional route of employing these skills directly, at least stop to consider the real costs and ongoing effectiveness of the direct employment versus outsourcing options.

There could be savings and other efficiencies just waiting for your bottom line.

To chat about outsourcing with us, just get in touch.

-

15Feb2019

Nailing the Big Picture – Remember Why You’re In Business

You can set up your plumbing business, get the marketing going, and be managing cashflow well… but why?

Why did you set up your own business, rather than work for someone else on wages? Are you achieving (or are you on track to achieve) the expected benefits of being a business owner?

The following are some tips to help you focus in the right areas and build a business and a lifestyle that is sustainable for the long term.

Link Your Financial and Family Goals

Running a small business is a journey taken by the whole family even if they’re not working directly in the business.

All the family should be included in the goal setting process:

What do we want to achieve financially?

What are our sport/recreational priorities?

What about education options?

Do we want to work towards a fun goal (eg trip, new pool etc) as a family?

What would happen to our plans if one of us gets badly injured or worse?

When everyone has a say, they are likely to buy into the differences and sacrifices that have to be made along the way – like Dad or Mum sometimes having to work late into the night or on weekends.

Never underestimate the tremendous value of having a supportive family unit behind your business.

Define and Design Your Work-Life Balance

No one wants to live and die behind a desk or on-site. Work never stops – but people will if they overload themselves.

You want to watch the revenue of your plumbing business grow but not at the expense of watching your children grow.

Those who are passionate about what they do need to guard against work becoming their life. Priorities can easily get skewed.

As a business owner, you must define a reasonable amount of time for you to spend working. Otherwise, you’re going to miss a lot of important moments.

Think about the type of life you want, talk to your spouse about what they consider a reasonable work week, and set a limit for yourself. Then stick to it.

Lead by Example

Unless you always want to be a one-person business, you will need to transition from worker bee to business developer.

As a leader, you need to lead but also pick when to get your hands dirty and directly support your team on the tools.

There are plenty of times when you will work late when you should be home enjoying time with family. Good employees will see this dedication and often ask if they can share the load.

However, it’s equally important to show your team that it is okay to go home early some nights.

If you employ the right people, you should be able to allocate the work, communicate the outcomes required, and not need to micromanage.

The need to micromanage is a sign that either you have employed the wrong people or that you have trouble letting go and trusting your team.

It is almost impossible to grow your business in a micromanaged environment.

Find Your Guilt Free Hours

You need to define and find guilt free hours for yourself, your partner, family and friends. No point having time away from work if you are not getting a complete break, both physically and mentally.

As a business owner, you also need to find guilt free hours to spend on business development. This might be a time when you are sitting in air conditioning at the office or at home while your teams are out on the tools. If you start feeling guilt about this you are thinking like a worker – not a business owner.

Do not feel guilty about sitting alone at your desk, or somewhere else where you do your best thinking. These quiet hours will help you delve into big ideas and organize your thoughts.

Lower Your Expectations

Time is the original non-renewable resource — we never have enough of it. Sometimes you can feel almost paralyzed by competing priorities.

You will never have enough time to do all of the things you need (or want) to do. Lowering expectations of what your achieve in a day/week/month or year can free a lot of stress.

Make peace with the fact that you will never be 100 percent in all aspects of our life. Aim for progress, rather than perfection and it will help you to move forward with the right mindset.

If carving out three hours free of distractions to explore an innovative new idea is not be possible, then start with what is possible and work up from there.

You will be surprised what you can achieve in an uninterrupted 30 minutes.

Plan To Make Yourself Redundant

The ultimate success will be when you own a profitable plumbing business that does not require your day-to-day input to keep it running.

You should start by making yourself the business CEO, but then move to being the Chairman of the Board – someone who reviews performance and has input into strategic direction, but leaves the day-to-day operational matters to a skilled and trusted team.

This process may take years, even decades, to achieve – but if you get it right you will no doubt be able to look back and put a tick next to all the why’s you identified when you started your plumbing business.