-

08Feb2019

Money is Hard To Earn – Don’t Let It Leak Away

After you win the plumbing job and complete the work, you need to get paid in the most timely manner possible.

And when you get paid, you need to know how much the business needs to function – and when it needs it.

The following tips will help keep the cash flowing:

Monitor Cashflow Performance

You need a system to monitor your cashflows. Start by looking at your trading terms and your aged receivables. This should show you how long, on average, it takes for you collect money owed to you.

If your trading terms are 15 days and it’s taking you more that 30 to collect most debts, then something has to change.

A professional accountant will be able to help you set up a system so you can identify the key numbers and review them regularly.

Employ The Right Debt Collector

For many, collecting outstanding debts is not a pleasant job. But there are some people with a personality type suited to this type of role.

Debtor management needs to be done politely, but you need a firm person to contact those that are slow and ask them to pay as soon as possible.

The person needs to be disciplined, relentless and able to set clear boundaries with the debtor, including agreeing on a date when the monies will be cleared so that they can be followed up either before or after this date.

For problem payers (usually more than 90 days) it can be handy to have a relationship with an external debt collector who can take over the process if it needs to get legal.

Make it easy for people to pay you

At a minimum, you should include bank account details on your invoice to allow people to direct debit the money.

Many also will use merchant systems such as EFTPOS so that debit and credit cards can be accepted.

Businesses that do not offer merchant facilities and ask for cash only will not only miss out on sales, but could also become a target of the tax office “cash economy” audits.

Use Technology To Collect Cash

If you have just been called out after hours to fix a leaking toilet, the best time to get paid is immediately after the job is complete and the clients are happy – so don’t be afraid to ask for payment there and then.

Performing a job early in the month and then sending the invoice out weeks later and offering terms should be absolutely avoided.

Most invoicing systems nowadays can generate invoices from smart phones and tablets and then emailed on the spot.

Smart plumbing businesses are embracing this technology so enjoying the fruits of being paid much more quickly.

Cloud accounting systems such as Xero are low cost and make this process very simple.

Check Your Credit Controls

For larger jobs, be very careful about the terms you offer. For jobs that stretch for more than one or two weeks you should be considering a deposit of periodic payment plan.

And any customer who wants credit should be prepared to have their credit record checked. If they refuse, then it should send alarm bells ringing. Better to walk away from a job offer than to work for a month and not get paid.

You can do your homework through credit data companies and/or ask for trade references or even insist on cash on delivery until you establish a solid and trusted relationship.

Usually a debt collection agency, if you use one, will offer credit check services for a relatively modest fee.

Next week: The Big Picture for Your Plumbing Business – Do You Know What It is and Are You Planning For It?

-

25Jan2019

Marketing Your Plumbing Business: How To Digitise Your Strategy

Looking at marketing your plumbing business?

You need to set yourself up with tools and tax structures then find customers so you can service and bill them efficiently.

Marketing Your Plumbing Business: Drawing In Customers

No point being the best and most competitively priced plumber in town if nobody knows about it…

Plumbers, like any other business, must advertise and sell their services to those who may need them.

But training as a plumber does not prepare you for putting together a marketing plan. Understanding your potential customers, where they source information and how they make decisions is vital.

Once you know who your potential customers are, you can target your marketing towards them.

Getting your marketing mix right can be a key to success. Getting it wrong can see a lot of money head down the drain.

There may seem to be a bewildering array of choices when it comes to marketing. But they can be distilled down to three general areas:

-

Digital Marketing

Online marketing is almost non-negotiable in today’s business world. In terms of potential reach and cost-effectiveness, it is almost unbeatable. Most potential clients nowadays expect you to have an online presence – somewhere they can look you up, confirm your contact details, read about your business and, most importantly, read the reviews left by your customers.

So once you make that leap, you will almost certainly need some help designing a website and making the most of your social media platforms such as Facebook, LinkedIn, Twitter, plus Google, Google Ads and Search Engine Optimisation (SEO). They not only need to be set up – but they need to be constantly updated and used to remain relevant and effective.

If you decide to employ some marketing help, do your research and try to find a marketing firm that specialises in trade-related businesses. You can search for these online or ask your accountant for a referral.

Researching the websites of similar businesses and taking note of the positive and negative features may help influence your website design.

-

‘Traditional’ Marketing

You have to start with the basics. Truck signage, work uniforms, business cards, letterheads and invoices should not only all carry details of your business but say something ABOUT your business. You need to think about the message that you want to convey to your existing and customers. Do you have a logo? What are your corporate colours? Does your business name convey the right kind of message? Can people easily read your signage and remember your contact details?

Then there’s the next level of options: direct mail campaigns, advertising signage and advertisements in printed and broadcast media. Some of these can be expensive, so it is often best to seek some advice on how best to coordinate your online and offline marketing options to produce the best result.

-

Marketing to Referrals

It is far easier to gain a new customer who’s been referred to you by a satisfied customer than to convert someone who is a cold prospect.

Whether it’s a satisfied customer ‘liking’ and ‘sharing’ your Facebook page, or giving your business card to a friend, referrals can happen in both worlds. You must make asking for, and marketing to, customer referrals a significant part of your overall marketing strategy.

Marketing Your Plumbing Business: Pushing the Button On Technology

Online marketing is just one form of technology that will help drive your business. But if you are planning to run your business with a manual invoice book and a shoebox for receipts you will very quickly be left behind your competitors.

Many free or inexpensive apps can be loaded onto your mobile phone or tablet that will help run your business more effectively and efficiently.

Invoicing systems and portable EFTPOS payment options can allow clients to be billed and pay immediately. Besides, there are apps like Everlance and Receipt Bank that will allow you to track expenses and motor vehicle mileage

You can also attach bookkeeping software, like Xero, to your business bank accounts. This provides an up-to-date snapshot of your financials and facilitates an efficient relationship with your admin and accountants.

There are also websites and databases, like Hipages and Houzz, that are frequented by people interested in home renovation and will connect local tradies with potential customers. Others, like Airtasker, can be a source of connecting people who need jobs completed with those available to carry out the work.

To find out more about how we can help your plumbing business, head to our dedicated plumbing page.

-

-

18Jan2019

Set Up Your Plumbing Business Properly To Make Sure Business Flows Smoothly

Last week we touched briefly on topics that are important to the set up and ongoing success of a plumbing business. This week, we look more closely at the first two of these topics – Digging Into The Detail and Building Solid Foundations.

Digging Into The Detail

Where have you come from?

Where are you now?

Where do you want to head in the future?

These are three key questions that need to be addressed very early with plumbing clients. As you could imagine, the needs of a young plumber setting up their first business out of his apprenticeship could be very different from an established business wanting to expand and bring in new partners.

Getting to know you as business owners – your priorities, family situation and goals – is an important start.

What type of plumbing business are you running or intending to run?

Plumbing businesses are NOT all the same. The size, scale and areas of expertise can vary greatly between different plumbing business. Some focus on home repairs, some on home building and others on large commercial contracts.

What sort of working resources do you need?

Are you intending to be a one person outfit, with one or two apprentices, or a large scale operation with admin staff and a team of sub-contractors. If you are a one person outfit, do you have a partner who is going to stay at home and do the bookwork?

Is yours a generational family businesses with potential succession planning issues as older generations move towards retirement?

Or are you in business with other unrelated people in some type of partnership/co-ownership arrangement.

And what is your expectation of how your relationship with your accountant will work?

Do you need just the basics, or do you want extra services to assist you to grow the business.

Taking the time to understand the current set up and the plans for the future can help ensure best possible decisions are made regarding business structure and resources.

Building Solid Foundations

Business Structure

Generally, the choice is between sole trader, partnership, trust or company. All of these set-ups have potential advantages and disadvantages in terms of tax, asset protection and sharing ownership. The key is to get the best solution for now, but with one eye on how your business may develop in the future.

Accounting/Admin Resources

There are many options when it comes to managing your billing, bookkeeping and general administration. You need to put in place systems that are appropriate for the type of business you are running and easy to use to the extent that it adds to the efficiency of your business.

Most accountants will have preferred options for different types of business – and different levels of service related to each of these options. Some businesses like to do their own bookkeeping and just have the accountant check the figures. Others find it more efficient to fully outsource their bookkeeping, because it avoids mistakes and gives them more time to spend marketing and engaging in paid work.

Legals

If you are in business with other people you will need a partnership or directors agreement that covers important topics areas of responsibility, decision making mechanisms and clear processes for entering and exiting the business. This needs to be drafted by a lawyer.

New business owners who hesitate to spend money on legals, can find it far more expensive to sort things out when they try to dissolve or otherwise exit from a business situation that is no longer working or when illness forces someone to retire. Other legals that should be addressed are your engagement and payment terms. You need to spend time with someone experienced in dealing with collecting unpaid debts BEFORE you have any debt.

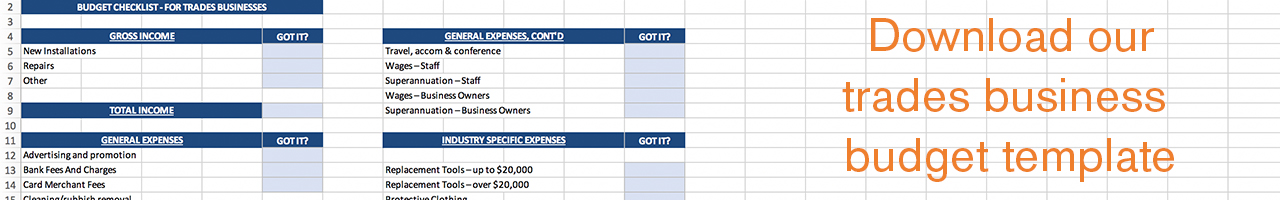

Plan The Finances

From the start, you need to look at your possible earnings and budget for ongoing and capital costs. You need to know how much you need to earn to cover ongoing business expenses, how much you need to pay yourself for personal/family expenses and how much you need for capital equipment – both upfront and replacement.

You need to distil this down into some simple numbers for your business plan – such as how many clients jobs you need to do per week (based on your average job size and mark-up) to cover your expenses and build up some back-up cash.

Insurances

Professional Indemnity and Public Liability are usually mandatory as part of being licenced. Your equipment also needs to be covered. And personal insurances also need to be reviewed and put in place to protect your income and your family should you be injured inside or outside the workplace. These all need to be part of the business budget.

These are the things that need to be part of your initial planning. The right moves at the start will help you run a successful business for the long term.

Next week: Drawing In New Business and Pushing the Button On Technology.

For help setting up your plumbing or trades business, contact us today.

-

14Jan2019

Five Tips To Designing The New Financial You In 2019

Job success never happens by accident. People plan, study and work hard for many years to achieve their career goals.

At Affinitas Financial Planning, we can help you channel that same steely determination into designing your financial future.

By working with us through these five simple steps, you can be well on your way to financial freedom by this time next year.

Live for Now AND The Future

You really can have a life now and start setting aside for the future. You are going to earn better money as the years progress – so you just need to get into the right financial mindset – one that strikes a balance between having fun and setting yourself up with long term investments.

Discuss and Set Goals

Once you start working, life can fly by at a pretty hectic pace. It can be of enormous benefit to sit down and just consider your short, medium and longer term financial gals. And there are no cookie cutter solutions. Every financial plan should be tailored to each specific individual or family group.

Do a Budget

This a very boring subject to many – but one of the essential building blocks of any financial plan. Once you know what you spend and plan for your regular bills, you will then know what you have left over for savings goals. We can help you through the budget process.

Make Your Bank Accounts Work Hard

Use electronic banking to separate your money into different accounts for different purposes. For example, many people find it handy to use three accounts – one for everyday expenses, another for bills and a third for savings. The trick is to treat you savings goals just like any other bill – money that must be set aside just like any other regular commitment.

Get The Safety Net In Place

You only have to watch the nightly news to realise how an adverse health outcome can negatively impact on financial plans. Get advice on putting good quality insurance cover (life, TPD, trauma and income protection) in place while you are young and fit – and make sure these levels of cover are reviewed as your circumstances change.

As you continue working hard in your career, don’t lose sight of WHY you’re working so hard.

Enjoy the fruits of what you have achieved now – but also start working towards a time when your investments will pay you enough income to allow you the freedom to decide when you want to travel, work or just put your feet up and rest.

So are your personal finances in healthy shape for 2019?

If not, get in contact with Affinitas Financial Planning today.

The above information is general in nature and the advice may not be right for you. You should consider the appropriateness of the advice in light of your own financial objectives, needs and situation before acting on the advice.

Affinitas Financial Planning is an Authorised representative of MGD Wealth Ltd, Authorised Representative No.283002

MGD Wealth Ltd is the holder of Australian Financial Services Licence No.222600. ABN 53 009 079 725, Ground Floor, 175 Melbourne St, South Brisbane QLD 4101

-

11Jan2019

Build Your Plumbing Business Right To Make Sure Profit Doesn’t Drain Away

At Affinitas, we’re good at plumbing.

We can’t fix a blocked drain or install a water reticulation system – but we are very experienced when it comes to the understanding the accounting and business planning needs of the plumbing industry.

It is this experience and knowledge that has allowed us to build some of our most successful client relationships with plumbers. In coming weeks, we are going to further discuss some of these knowledge areas and profile some of the different plumbing businesses that are part of the Affinitas family of clients.

These knowledge areas will include:

Digging Into The Detail

Plumbing businesses are NOT all the same.

Some focus on home repairs, some on home building and others on large commercial projects. The size and scale of plumbing businesses can vary greatly depending on these areas of specialisation – from a one person outfit with one or two apprentices, to a large scale operation with admin staff and a team of sub-contractors. Some are generational family businesses and others involve a partnership/co-ownership arrangement. Taking the time to understand the current set up and the plans for the future can make sure the best decisions are made around your business structure and resources.

Building Solid Foundations

Whether you are starting a business or buying a business, business planning and understanding the needs of your market is an important starting point. The tax structure of the business (sole trader, company, trust or partnership) must suit the type of business being run, the number of owners, plus the potential cashflow and profitability. Then accounting and bookkeeping systems need to be installed that suit the size and scale of the operation. If you are a good plumber, you should not be trying to turn yourself into a bookkeeper.

Instead, you should be outsourcing and focusing on the skills that make you money.

Drawing In Business

Plumbers, like any other business, must advertise and sell their services to those who may need them. But, like many tradespeople, plumbers are often much more comfortable fixing a blocked S-bend than putting together a marketing plan. But understanding your potential customers, where they source information and how they make decisions is vital. Getting your marketing mix right can be a key to success. Getting it wrong can see a lot of money head down the drain.

Pushing the Button On Technology

Even for a very small set-up, employing smart technology can drive efficiencies that will save you time and money. Portable EFTPOS payment options on your phone or tablet can allow clients to pay immediately, for example. There are also all sorts of apps that help you track expenses, monitor mileage and even efficiently schedule your jobs. Modern bookkeeping systems can be attached to your business bank accounts too.

These can provide a daily snapshot of your business financials and facilitate an efficient and effective working relationship with your admin staff and external accountants.

Not Letting Money Leak Away

Pay attention to cashflow planning, air-tight quoting, efficient invoicing and prompt debt recovery. Plan for capital equipment upgrades and payment of staff wages, superannuation and tax obligations. Knowing what to do in these areas will make sure you are properly pricing your jobs to produce the right gross margin and net profit.

No point in winning work that isn’t profitable.

Nailing The Big Picture

When you go into business, you need to start at the end. Why are you in business and what do you wish to achieve for yourself and for your family? Write this down and always revisit your business progress in light of these goals. This is what business planning is all about. If you are not making progress towards your goals, then you need to question whether the business is healthy. Or whether your goals remain relevant?

In coming weeks, we’ll dig into further detail on these subjects. Plus, we’ll talk to some our plumbing clients working at the coalface. Stay tuned.

-

13Dec2018

Top 10 New Year Resolutions for Small Businesses

Every New Year provides the opportunity for a fresh start – and this is especially true for a small business owner.

Most small business people get to take at least some time off during December and January to recharge their batteries.

So what are the New Year business resolutions that could turn 2019 into a bumper business period?

-

Learn To Delegate and Do More of It

Small business people are amongst the worst at convincing themselves that they need to do it all. This leads to inefficiencies and tired and overworked business owners who can never find the time to spend on the critical planning and growth areas of their business. Start by delegating some of the small tasks to others and see how it starts to free up your time. If you can get this area right, you’ll have a better business and a better work-life balance.

-

Promote Your Business Regularly and Consistently

The task of attracting new customers and keeping the existing ones happy is often at the bottom of the To Do list. Promote it up the order and work on creating a marketing plan – either by yourself or with the help of marketing professionals. Then, remember Point No. 1, when you identify marketing tasks that need to be followed through, delegate wherever possible.

-

Make Business Planning a Weekly Event

Analysing what is working and not working and analysing progress towards your goals should not be just a one per year or half year job. The business environment is ever-changing and you need to be constantly assessing your progress and planning ahead. This is one way where you can avoid making costly mistakes.

-

Learn Something New

New skills can help you grow as both a person and a business leader. Sometimes these new skills can be directly related to business. Others can be totally unrelated to business, but just designed to give you important time and head-space away from business. Plus you’ll potentially be a more interesting person to talk to at dinner if you have interests that are outside of your business.

-

Join a Business Organisation or Networking Group

These can be helpful as a source of new business, but also as a source of business ideas. They can either be specific to your industry or draw on people from different backgrounds. Both these mixes can be helpful. Do your research prior to joining one of these groups and make sure what it’s offering can help you achieve your business goals.

-

Give Back To Your Community

Small business is always part of a community. It’s likely that many of your customers are involved with the same schools, churches, charities and other community groups as you and your family. Always get involved for the right reasons. People will recognise your efforts and goodwill will grow. Some small businesses often decide to use this type of volunteering as a group effort – something that will bind the team together away from the day-to-day pressures of being in business.

-

Put Time For Yourself In The Calendar

The success of a small business always depends on the input of the owners. Happy and healthy owners make better business decisions and are more likely to have the energy, commitment and foresight to run a long term, profitable business. Don’t look at it as goofing off or being lazy – look at it as investing in yourself for the long term good of you, your family and your business.

It’s relatively easy to plug big numbers into a budget forecast and come up with a fantastic projected result. But there is nothing more deflating than seeing those forecasts not met month after month. You have to set business goals that will stretch you and your team – but they have to be realistic, even if they are not easily achievable. Otherwise, you are just running your business on pipe dreams.

-

Don’t Just Make Do – Get a New One

Re-look at your business after a rest and see if you can identify any road blocks to productivity. Whether it’s old, unreliable equipment, or team members who are just not suited to the roles they have been given – it may be time to consider replacement. The cost of replacing things that aren’t working is sometimes much less than the long term costs of struggling on with inefficient equipment or team members.

-

Drop What’s Not Working And Move On

Whether it’s outdated sales methods, computer systems or unreliable suppliers/contractors, don’t continue spending time trying to make the unworkable workable. Make a change and move on, because almost inevitably when you do you will find something or someone who is a better fit for your business.

So what are your New Year’s Business Resolutions going to be?

Will they be the ones that make a real difference to your life and your bottom line in 2019?

Source: Ward, Susan. Top Ten New Year’s Resolutions For Business Success. The Balance Small Business, August 22, 2018.

-

-

07Dec2018

Top 10 Tips for Turning a Festive Season Profit

For many, Christmas is known as The Season To Be Spending.

But with a bit of forethought, you can often turn things around and earn some extra cash over the holiday season.

For individuals and families, there are quite a few alternatives that could be considered.

-

Renting Out Your Home

Christmas holidays is the time when people are on the move visiting family and friends. If you are heading away over the holiday period, you might want to consider offering your house as a potential rental. Services like Airbnb can help you market and facilitate this type of short-term rental.

-

Keen Cooks

If you are a dab hand in the kitchen, you may find there is a market in making some extra Christmas goodies. Many people nowadays chose to buy Christmas cakes, plum puddings, plus seasonal sweets like White Christmas and will be happy to pay for genuine home made articles.

-

Handy Hobbies

If you are handy at woodwork, cabinetry, metalwork, sewing or general arts and crafts, then there is a market to service people looking to source and buy traditional hand-made gifts.

-

Angles for Anglers

The consumption of seafood reaches a peak over the Christmas holidays. If you are a keen and skilful angler, and able to catch an excess of prawns, crabs or fish, you may find many workmates and neighbours who are keen to source their seafood from someone they know and avoid the long pre-Christmas lines at seafood outlets.

-

Be Fruitful

Many people nowadays are making the most of their gardens to grow their own vegetables and fruits. If you are lucky enough to have excess of good quality home grown, mangoes, cherries, watermelons or citrus fruit, then there will be plenty of people willing to buy.

For businesses, the quiet times can provide an opportunity to inject extra cash into the coffers for the New Year.

-

Show Me The Money

If you have been busy completing work in the lead up to Christmas, you may have fallen behind with your invoicing. Use this time to get all your invoicing up to date – and hopefully your debtors will be filled with the spirit of Christmas – and pay on time.

-

Follow Up Leads

There may have been enquiries come through in the past few months that you have not had time to fully explore. Over the quiet Christmas period, you should follow up these business leads. Who knows, the people who have contacted you might be interested, but just have not had the time to assess your proposal. A timely follow up from you could put you ahead of the pack.

-

New Year Deposits

You probably have a list of jobs that you know needs to be started in the New Year. You can use the time to schedule these jobs into your work calendar and take deposits from clients to secure the starting date.

-

Sell Surplus Assets

If you get a chance to get out of your office and have a walk around your factory or work compound, you may be able to identify equipment or other assets that you are no longer using. Rather than keeping these lying around, you might be able to sell them and inject some extra capital into your business.

-

Review Expenses

As the year winds down, you may finally have time to pull out the reports sent to you by the accountants and look through your list of work expenses and identify areas where you might be able to make savings – and improve your margins.

None of the above should take away from your enjoyment of the Festive Season. In fact, if you are able to free up some extra cash, or have your early New Year work schedule better organised, it can only help make your holiday break a stress free and relaxing time.

-

-

29Nov2018

Fringe Benefits Tax and the season to be jolly!

Don’t let Fringe Benefits Tax (FBT) become the Grinch that spoils Christmas for your organisation.

If you are the person in charge of organising your work Christmas festivities, you need to make sure that they comply with current FBT guidelines.

There is scope within the FBT rules to celebrate, but you need to know how they work, or consult someone who does. That might be someone in the internal accounting team or, in a smaller organisation, you may need to chat with your external accountant.

When planning your Christmas party list (and checking it twice), consider:

- How much it costs

- Where and when it is held – a party held on business premises on a normal work day is treated differently to an event outside of work

- Who is invited ? Is it just for employees, or are partners, clients or suppliers also invited?

Christmas presents or gifts may also attract FBT. You’ll need to consider:

- The amount you spend

- The type of gift – gifts of wine or hampers are treated differently to gifts like tickets to a movie or sporting event

- To whom who you are giving the gift? There are different rules for employees and clients or suppliers.

Early planning will allow you to either avoid paying FBT or start planning now for how much FBT you will have to pay on top of the costs of the function and gifts.

Christmas parties

There is no separate fringe benefits tax (FBT) category for Christmas parties and you may encounter many different circumstances when providing these events to your staff. Fringe benefits provided by you, an associate, or under an arrangement with a third party to any current employees, past and future employees and their associates (spouses and children), may attract FBT.

Implications for taxpaying (non-exempt) organisations

If you are not a tax-exempt organisation and do not use the 50-50 split method for meal entertainment, the following explanations may help you determine whether there are FBT implications arising from a Christmas party.

Exempt property benefits

The costs (such as food and drink) associated with Christmas parties are exempt from FBT if they are provided on a working day on your business premises and consumed by current employees. The property benefit exemption is only available for employees, not associates.

Exempt benefits – minor benefits

The provision of a Christmas party to an employee may be a minor benefit and exempt if the cost of the party is less than $300 per employee and certain conditions are met. The benefit provided to an associate of the employee may also be a minor benefit and exempt if the cost of the party for each associate of an employee is less than $300.The threshold of less than $300 applies to each benefit provided, not to the total value of all associated benefits.

Gifts provided to employees at a Christmas party

Providing a gift to an employee at Christmas time may be a minor benefit that is an exempt benefit where the value of the gift is less than $300.

Where a Christmas gift is provided to an employee at a Christmas party that is also provided by the employer, the benefits are associated benefits, but each benefit needs to be considered separately to determine if they are less than $300 in value. If both the Christmas party and the gift are less than $300 in value and the other conditions of a minor benefit are met, they will both be exempt benefits.

Tax deductibility of a Christmas party

The cost of providing a Christmas party is income tax deductible only to the extent that it is subject to FBT. Therefore, any costs that are exempt from FBT (that is, exempt minor benefits and exempt property benefits) cannot be claimed as an income tax deduction.

The costs of entertaining clients are not subject to FBT and are not income tax deductible.

Christmas party held on the business premises

A Christmas party provided to current employees on your business premises or worksite on a working day may be an exempt benefit. The cost of associates attending the Christmas party is not exempt, unless it is a minor benefit.

Christmas party held off business premises

The costs associated with Christmas parties held off your business premises (for example, a restaurant) give rise to a taxable fringe benefit for employees and their associates unless the benefits are exempt minor benefits.

If you are unsure about how FBT might impact on your office Christmas plans, contact or phone 07 3510 1500.

Source: Fringe Benefits Tax and Christmas Parties. ATO Website, 2018.

-

23Nov2018

10 Tips To Help You Get Ahead Of Your Christmas Cashflow

Whether it’s finishing work, or attending social events, the lead up to the Christmas holidays each year is a busy time.

But amongst the whirl of work projects and parties, it’s worthwhile taking time out to think about your business cashflow over the Christmas/New Year period.

If you are in a business which traditionally has a slow period between 25 December and the end of January, then you need to think through what you can achieve in turnover and what expenses will need to be met.

Take some time to review the following points, so you can assess and plan your cashflow needs.

-

What kind of work can you complete before Christmas and in January?

-

If you complete the work, are the clients likely to pay over the December/January period?

- Can you encourage/incentivize them to pay early?

-

What are the key expenses you need to fund over the break?

- These can include wages, rent, power and finance payments.

-

Are there any extra festive season related expenses that you need to fund?

- Xmas parties, client/staff Xmas gifts, festive season decorations?

-

Don’t forget as business owners, you also are going to need to take a break and spend time with family/friends.

- Holidays, even if you stay at home, cost money.

-

Remember the collection of tax/GST/Wages PAYG does not really stop over the festive season.

- So review key dates for lodgement and payment of these obligations.

-

Stock and materials.

- Will you need to replenish and make an order in the New Year?

-

Review your human resources.

- If you get the work orders in, will you have the staff ready and able to complete the work? If not, do you need to think about casuals/contractors?

-

If it looks tight, what are your options?

- Cashflow finance? Discount & sell off surplus stock or redundant assets? Review bad debts and payment arrangements?

-

If you need cashflow finance, start the process early.

- Get it in place before you need it and beware that all finance institutions slow down processing and approvals as Xmas/New Year approaches.

If you need help with any of these tips, please contact the helpful elves in the Affinitas Accounting team on 07 3510 1500 or .

-

-

15Nov2018

What Happens To My Tax Return After October 31?

If you still haven’t lodged your 2018 tax return, don’t despair – you still have options available.

The government’s MyTax service is still operational if you wish to self prepare your return. But you are officially late if you use this service. The ATO suggests that you contact them to discuss your reasons for being late.

If, however, you have used a registered tax agent to lodge your return in the past, you might not be late for 2018 provided you are all up to date with the previous year’s lodgements.

You do not have to return to the same registered agent to access the extended lodgement deadlines.

Transferring to any registered agent with a good lodgement history should enable you to access the extensions.

A professional registered tax agent will help you liaise with the ATO, prepare and lodge the returns, and help you navigate any problems there might be with your lodgements. You’ll be back on track as soon as possible.

If you are avoiding visiting your accountant because you believe you may owe the ATO some money, the best strategy is to get the return prepared and know what sort of debt you are facing. You can then use the extended deadlines to delay the lodgement and have the money ready to pay the ATO.

In other words, if you have a 15 May lodgement deadline, best to have the return done by December and then have 6 months to save/plan how you are going to pay the debt.

This is a much better strategy than waiting until early May to prepare the return and discover the debt is more than you expected, with no time to prepare for the payment.

And if you get more than one year behind, do not put your head in the sand.

Make sure you get yourself up to date as soon as possible.

This is where an experienced tax accounting firm can help you with backdated lodgements. We will guide you through the process and take the weight off your shoulders.

At Affinitas Accounting we have had more then 20 years of experience helping clients with late and backdated tax return lodgements. Some result in tax debts to pay – but others can result in unexpected windfalls.

And if you cannot get to the office for an appointment, contact us on 07 3510 1500 or at about using our postal or email service.