-

17Aug2018

Why Does Deb Ask So Many Questions?

It is great to welcome new tax clients to our practice each year.

Many of these new people have been recommended by existing clients or have Googled us and been impressed by the number of positive reviews and ratings. During appointments with these new clients, many comment that we do ask a lot of questions (compared with their previous tax accountant).

Given these comments, we thought it was worthwhile tracking through some of the main reasons we run through a comprehensive list of questions with clients each year as part of their annual tax return interview with us.

We Want To Get To Know You

Unashamedly, it is our goal to turn every new client into a long term raving fan of our firm.

We believe this is achieved by being excellent tax accountants AND by getting to know about you, your family, your job, plus your hobbies and interests.

This not only makes your annual interview a more personal experience, but it also helps us hone in on areas where we can provide you with the best possible advice.

Accounting for All Income

Even as an individual employee, there are 17 different types of income that may need to be included in your annual tax return.

Some, like your annual PAYG summary, are obvious, but others like your bank interest, dividends, taxable Centrelink payments or capital gains from selling shares (or cryptocurrency) are easily for gotten.

It’s also important that we account for a full 12 months of your income – often people forget a brief part-time job they had for just a few weeks that needs to be included. If you’re operating a rideshare, there are rules around that too.

Not Missing Any Deductions

There are well over 20 potential line items for deductions on a personal tax return. Many more if you have a rental property. It is important to work through this list and make sure we have not missed anything that could get you some extra dollars back in your return.

But identifying potential deductions is just part of our job. We also need to ensure that you have kept the right records that allow you to make the claim. It is our duty of care to ensure you get the best possible tax result, but that the return would pass an audit from the ATO.

On many occasions we identify that clients might have a potential claim but not the records to prove that claim. So, we make sure you leave armed with what you need to do to make that claim in your next tax return.

Other Rebates & Offsets

Things like where you work, your age, your family situation, your level of income and whether you have private hospital insurance or a HECS debt can affect the outcome of your tax return by imposing extra levies, or reducing tax through offsets.

We need to be on the lookout for indications that these situations apply, explain how they could affect you – and whether anything could done in future years to better manage any of these outcomes.

The Tax Rules Change

Even for clients with whom we have a long history, rules relating to allowable deductions and related record keeping can change from year to year.

Also people’s incomes, investments, work arrangements and family situations can be different from when we last met.

It is important that we don’t just cut and paste last year’s deductions onto this year’s return. The ATO and the government do tweak and change the rules constantly and it is our job each to make sure your tax return is prepared under current rules and guidelines.

Conclusion

So, whether we pose them face to face or via the internet, there are good reasons why Deb (and all our tax consultants) will ask you lots of questions each year about your tax return.

To book in for this year’s list of tax questions, contact us on 07 3510 1500, email us at , or reach us through Messenger below.

-

10Aug2018

Tradie Tax Confusion

Five Strategies To Help Avoid The Year Two Business Cashflow Blues

Moving from earning wages to owning a business can be a confusing time for tradespeople, especially when it comes to tax.

Building your business but not your bank account?

You may know a lot about plumbing, electrical wiring or carpentry, but understanding how the business tax system works can be one of the biggest challenges of going out on your own.

Most tradies start working for themselves under an individual ABN, which is the simplest way to get set up and ready to invoice.

Under this system, you have income tax obligations from day one, but in the first year you are not required to calculate or pay income tax until you complete that year’s tax return.

So it can be more than 12 months before you know how much income tax you owe the Federal Government.

If you have not set aside any money for your tax obligations during that first year, then you will find yourself playing catch-up at the same time as the ATO wants you to start pre-paying towards your anticipated tax bill at the end of your second year.

It is for this reason that many tradies really feel the cashflow pinch during their second year of business.

But an early meeting with your tax accountant to discuss a few simple strategies can help you avoid these second year business cashflow blues.

-

Budget for Tax From The Start

You need to make a reasonable estimate of your turnover and profit of your first couple of years in business, then plan how much tax and/or GST you may need to put aside every week.

-

Individual v Business Income Tax

It may feel like you are paying more tax, but, ultimately, if you earn $100,000 in wages, or make a $100,000 business profit under an individual ABN, then the tax you owe is the same.

-

Understand the First Two Year Tax Cycle

Realise that the first year, when you are not required to pay any tax, is not the reality of being in business. You will get a tax bill to pay at the end of year one and then the ATO will start expecting you to pay towards what they estimate will be your second year taxable profit.

-

Get Your Year One Business Tax Return Done Early

If you do have a tax bill to pay, find out early. Then if you fall a bit short, when you still have some time to plan how you are going to find some extra cash.

-

Get Into The Right Tax Mindset

Tax and GST is not your money to spend, so get it away from your working bank account right from the start. It will make sure you are assessing your business performance based on real figures – ie the dollars left over after you allow for paying your tax obligations.

For help understanding your tax obligations as a tradesperson, contact Affinitas Accounting on 07 335 5244 or . You can also reach us through Messenger below!

-

-

03Aug2018

Salary Sacrifice for Medical Professionals

Working as a medical professional in a private or public hospital allows you to access a tax free salary sacrifice benefit.

This is a great benefit not generally available to those who do not work in hospitals or not-for-profit (charity) organisations.

This equates to a tax free amount of around $9,000 per year coming straight off your gross income that can be spent on non deductible private expenses such as rent, a home mortgage, gym memberships, car registration, private health insurance or personal travel.

Good for Cashflow, Good for HECS Repayments

But often new doctors entering the salary sacrifice system with HECS debts do get an unwelcome surprise in the form of a tax bill. This is because the salary sacrifice reduces the income tax and Medicare you owe, but does increase the amount of HECS repayment that is calculated on your tax return.

In simple terms, the salary sacrifice will give you access to about $343 tax free per fortnight. If you take this up and increase the fortnightly tax you pay by $80, then it should ensure no nasty tax bill surprises. This can be done via submitting a form to payroll.

And the other benefit is that, the salary sacrifice actually channels less into paying income tax and more into repayment of your HECS debt – meaning you will get to pay your HECS debt down faster.

For example, if you earn $100,000 of taxable income without salary sacrifice, and have private health insurance, you will pay $24,327 in tax, $2,000 in basic Medicare Levy and $7,500 in HECS repayment.

If, however, you take roughly $9,000 of your $100,000 in tax free salary sacrifice, then you will pay around $21,000 of income tax, $1,800 in basic Medicare Levy and $8,600 in HECS repayment.

These final figures also can be reduced by tax deductions on your return, such as exam/college fees, medical registration, and tax deductible insurances such as medical indemnity and income protection.

If you would like an assessment of your personal tax/HECS situation, click through the image below and get in touch with your details.

Diagnose the health of your medical business with our help through here.

-

20Jul2018

Beware of Tax Time Scams

Taxpayers need to watch out for fraudsters who use tax time as an opportunity to extort money and personal information from unsuspecting victims. The ATO has warned that tax scams spike at this time of year.

Assistant ATO Commissioner Kath Anderson said most Australian taxpayers expected some form of interaction with the ATO during tax time and scammers would try to use this to their advantage.

Last year the ATO received more than 81,000 scams reports, with more than $2.4 million being paid to scammers and almost 10,000 people providing their personal information. Just under half these reports were received during tax time.

Ms Anderson said the most common scam was still the “fake tax debt” phone scam, but the “fake refund” or “refund for a fee” scams also were on the increase. The fraudsters also ran email and SMS scams enticing people to click a hyperlink, download a file or open an attachment and divulge personal information.

Ms Anderson said knowing how scammers worked was an important part of protecting yourself.

“Scammers are aiming to make money and use a range of tactics. They may get money up front by pressuring you into paying a fake debt or by tricking you into paying a fee to have a refund released,” she said.

“They may also get you to click on a link to divulge your login, personal or financial information, or to download a file or open an attachment which enables them to access your data. Once they have your data, they can either sell it or use it to impersonate you for financial gain.”

Ms Anderson said scammers frequently claimed to be from the ATO and she warned people to be wary of any phone call, text message, email, or letter about a tax refund or debt – especially if you were not expecting it.

The ATO regularly sends emails and text messages and makes lots of phone calls each week but there are some tell-tale signs that the caller was not from the ATO.

Ms Anderson said the ATO would not:

- use aggressive or rude behaviour, or threaten you with arrest, jail or deportation;

- request payment of a debt via iTunes, pre-paid visa cards, cryptocurrency or direct credit to a bank account with a BSB that isn’t either 092-009 or 093-003;

- request a fee in order to release a refund owed to you; or

- email or SMS you asking you to click on a link to provide login, personal or financial information, or to download a file or open an attachment.

But there are some simple safeguards:

- Know your tax affairs – you can log into myGov to check your tax affairs at any time, or you can contact your tax agent or the ATO;

- Guard your personal and financial information – be careful when clicking on links, downloading files or opening attachments. Only give your personal information to people you trust, and try not to share it on social media;

- If you are unsure about whether a call, text message or email is genuine, do not reply. Call the ATO on 1800 008 540;

- Talk to your family and friends about scams. And if you or someone you know has fallen victim to a tax related scam, contact the ATO as soon as you can.

The ATO has a dedicated phone line for reporting scammers: 1800 008 540.

Further information on how to protect yourself is available through here.

Are you a risk to yourself? Take the ATO’s scams quiz to find out.

If you think you’re being scammed, contact us today for help. Call us on 3359 5244 or email .

-

13Jul2018

Does The Tax Office Owe You Pots of Money?

A very nervous couple came to our office recently and confessed to having 12 years (each) of overdue tax returns.

With our help, they are now up to date, extremely relieved and $85,000 richer.

We’ve helped a couple with 12 years of overdue returns get $85, 000 back from the ATO. We can help you too.

People who get behind with their tax returns can sometimes put their heads in the sand. The task begins to look too hard and fear about the likely outcome grows.

But getting yourself up to date can be a lot easier than you think – especially with the right help on board.

After 25 years of completing backdated tax returns for clients, the following are five of the most common tax arrears fears:

Where do I start?

Like the journey of 1 million miles, it starts with the first step – and that often is making an appointment with a professionally qualified registered tax agent. Put your time line together and bring in whatever records you have, photo ID and your tax file number.

How do I get old information if I don’t have it on file?

Once you are registered as a client with a registered tax agent, they can often access information through online resources at the ATO. In some cases, we can even write to the ATO and request copies of former returns.

Will I be fined?

Technically, the answer is yes – and individual taxpayer can be fined up to $850 for a late lodgement. In practice, if you are a wage earner and the ATO owes you money in refunds, the fines are often minimal or Nil.

Should I expect a bill or a refund?

This will depend on individual circumstances, but the obligation to lodge will not go away by ignoring it. And, who knows, there could well be a pot of money waiting for you when we add up all the results.

Am I the only one this far behind?

People of all ages and stages of life – old or young, rich or poor, blue collar or professional – can get behind with their tax return lodgements. And whether it’s one year or 12 years, we’ve seen it all.

So, if you are behind lodging your tax returns, why not take that first step in the journey? If you’re over three years behind, get in touch to claim a year’s return processed for free.

Contact Affinitas Accounting today on 07 3510 1500, email , or reach us on Messenger below.

-

06Jul2018

5 Most Common Tax Mistakes, Straight From The ATO

Are you ready for a call from the ATO?

Contact will be made with taxpayers either directly or via their registered tax agent in the coming months. With tax time 2018 already having begun, the ATO has published the five most common tax mistakes identified in recent audits and reviews.

More than 1 million taxpayers will soon be contacted by the ATO as part of an education campaign focusing on common tax mistakes.

ATO data revealed the top five mistakes include:

- taxpayers who leave out some of their income;

- those who claim deductions for personal expenses;

- those who fail to keep receipts or records;

- those who claim for something they never paid for;

- those who claim personal expenses for rental properties.

ATO assistant commissioner Kath Anderson said the tax office would be taking a more proactive approach this year in a bid to clamp down on agents and taxpayers who push the boundaries. “We are increasing our investment in education and assistance, as well as reviews and audits. This year we are expecting to make contact with more than 1 million taxpayers either directly or through their agents,” Ms Anderson said.

“This tax time we will be paying close attention to claims for private expenses like home to work travel, plain clothes, and private phone calls. We will also be paying attention to people who are claiming standard deductions for expenses they never paid for. Around half of the adjustments we make are because the taxpayer had no records, or they were poor quality.

Further, Ms Anderson said the ATO would be taking a close look at income issues, such as temp jobs, cash jobs and capital gains on cryptocurrency.

ATO data matching technology also will target income from the sharing economy (eg. ride sharing or AirBnB-style renting), work related clothing/laundry claims, and work related car expenses.

More than ever, it’s important to gather your receipts and discuss your record keeping as part of your annual tax appointment. Contact Affinitas Accounting on 07 3510 1500 or for anything you need this tax season.

-

29Jun2018

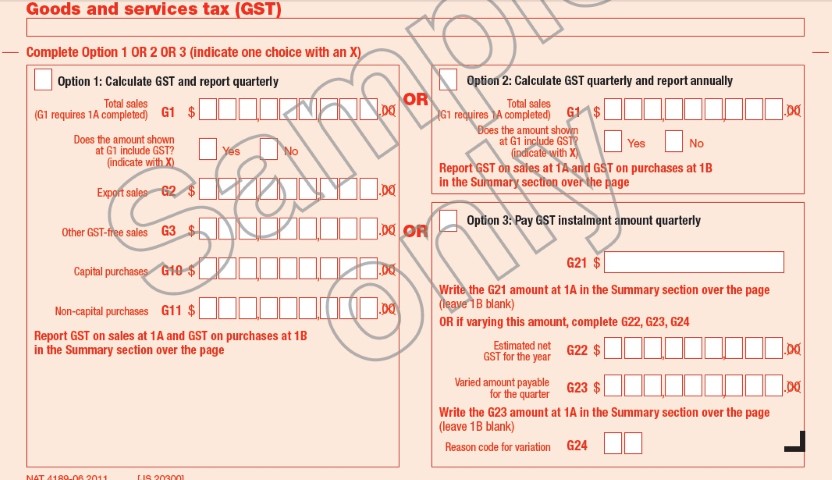

Suffering a Bad Case of EOFY BAS?

The end of financial year (EOFY) business activity statement (BAS) is an important document due at a very busy time.

Don’t suffer from a bad case of EOFY BAS

It looms as businesses finalise their results for the year, collect debtors, pay creditors, round off the year’s payroll, search for extra deductions and plan the year ahead. All this needs to be incorporated in the final quarter BAS numbers.

And you can add to this the mid-year school holidays, when families like to have time off together.

If you are struggling to get all this done by the end of July, then you need to reach out for help.

This can be in the form of improved software and/or apps, or extra internal or external accounting support.

Trying to do everything yourself can be false economy.

Consider spending a few extra dollars on getting the right support in place, so you can free your time to focus on family or boosting the sales side of your business.

To discuss, phone Affinitas Accounting on 07 3510 1500 or service @affinitasaccounting.com.au.

-

22Jun2018

Cashflow Control – Making Sure You Don’t Run Out of Money

Cashflow is king when it comes to running a small business.

In business, you can make any number of profits (or losses) for tax purposes – but you can only run out of money once. As the name suggests, cashflow management is all about managing the movement of dollars in and out of your bank account, by understanding how a business works, having access to adequate working capitalm, and adopting a planned and proactive approach.

Running out of cash is stressful, embarrassing, and not good for your wellbeing. Then there are the additional costs and finance charges that generally follow. The following tips will help you come to grip with your cashflow needs and work with your accountant and finance team to put the right cashflow strategies in place.

Cashflow is king.

1. The first step in understanding and accepting the amount of working capital your

business needs to operate.How much inventory do you hold? How far behind in invoicing are you, or how much cash is tied up in work in progress? What do your customers owe you? How long does it take from paying your suppliers for the materials to extracting cash from your customers? All these will soak up your cash like rain in a desert.

2. Next, ensure your business has enough cash to fund your working capital needs.

The Rule of Thumb is often keeping three months worth of outgoings in the bank for a rainy day. If you find it difficult to accumulate this cash in the business, then make sure you have a buffer of some sort, either personal funds available or an overdraft or revolving credit facility. Or maybe cut your drawings, as retained profits are by far the best and cheapest source of working capital.

3. Plan ahead.

No good finding out in your quiet season that you cannot survive until things pick up AFTER you’ve already reviewed and agreed your borrowing facilities with your bankers at your annual review some months ago. Prepare BOTH budgets and cashflow forecasts for the coming year. If you find it difficult to predict your sales, complete all the outgoings first, and then see what sales you need to cover your outgoings. At least then you have a target.

4. Monitor month by month.

Know what your monthly spend is and review your actual cashflows every month against the budget and cashflow forecasts. This provides you with early warning signs for upcoming shortfalls, when payment arrangements might need to be arranged with, for example, the ATO. Problem sorted, and no last minute panic and stress!

5. Review critical cashflow systems.

Do you forget to invoice customers? Do you invoice as you go or just at the month end? How quickly do you collect your accounts receivables? Many do not even know how much is owed to them by their customers or how much they owe to suppliers. Do you capture all time, costs or disbursements to invoice? When was the last time you checked suppliers costs to ensure you haven’t been overcharged or been billed for items you haven’t received?

6. Speed up your cash conversion cycle.

This measures the time span between a business disbursing and collecting cash. 180 days or more is very common, especially in manufacturing or businesses with inventory. Ask for a deposit, put customers on retainers or get them to pay monthly. Cut your inventory levels, maybe by arranging for your suppliers to deliver the same or next day, or negotiate longer payment terms. Many businesses who focus on this get the cycle way below the 180 days cycle.

7. Make it as easy as possible for customers to pay you.

Always quote your bank account number on your invoices, and ask for direct credits or automated payments. Accept EFTPOS and credit cards, and set up a PayPal account on your website. Why wait for a cheque to be posted in this day and age?

8. Always be on the lookout for ways to cut costs or improve revenue.

If something or someone does not save money or produce income, question its value. Review your suppliers, phase out products or service lines that do not fully contribute, fire your ten worst customers and bite the bullet with difficult or unproductive team members.

To discuss how to implement strategies to improve your business cashflow, contact Affinitas Accounting on 07 3510 1500 or email . Alternatively, you can reach us on Messenger below.

Source: Roberts, Nick. 8 Tips for managing your cash flow. MYOB, 4 Oct 2012.

Source: Roberts, Nick. 8 Tips for managing your cash flow. MYOB, 4 Oct 2012.

-

19Jun2018

Top Tax Tips For First Time Property Investors

First time property investor?

If you’ve taken the plunge this year and are first time property investor, your rental portfolio does mean changes to your tax return this year.

The following tips will help you prepare for this year’s all-important meeting with your accountant.

A new rental property changes your tax reporting requirements.

Cost Base Details

In this first year you should bring all the details in relation to the purchase of the property – the contract, stamp duty, legal fees, loan application fees, inspections etc. These will all form part of the property’s cost base – which needs to be recorded for capital gains tax purposes. It’s much easier to record these details on your file now then to try to find the documents when you sell the property in, say, 10 years’ time.

Depreciation Schedules

Depreciation claims against your property can add a lot of value to the annual tax outcome. To claim depreciation you need to pay a quantity surveyor to prepare a Depreciation Schedule. These normally cost between $500 and $1000 (tax deductible) but can add many thousands of extra dollars to your refunds.

Rental Records

If you are not sure what records you should keep and expenses you can claim, contact your accountant BEFORE your appointment for a list of what you need. It will make your appointment much more efficient.

Refunds – Lump Sum or via Your Pay?

Everyone’s family budget is different. Some people like their rental property refund in one lump sum at tax time, while others may prefer just to pay less tax during the year. If you think this latter option might suit you, discuss a PAYG Variation with your accountant.

Not sure what these terms are? Intimidated by the paperwork involved in your new rental property at tax time? To get more information on these or any other rental property topics, contact us on 07 3510 1500, email or reach us on Messenger below.

Find out how you can get ahead of 80% of property owners and claim your tax deductions.

-

12Jun2018

5 Fun Facts About The $20k Instant Tax Write-Off

In May, the Federal Government renewed its commitment to allowing small businesses to receive an instant tax write-off for capital assets costing up to $20,000.

The following five facts might help you decide whether you want to take advantage of the asset write-off before 30 June.

- It’s a great opportunity for small business owners to purchase capital business items worth up to $20,000 and claim an immediate tax deduction. Cars, laptops, and even coffee machines count.

- The deduction threshold is per item. This means you can buy multiple items as long as each item is less than $20,000, net of (minus) GST.

- Be careful if you buy a number of items less than $20,000. When combined, they might make up one item worth more than $20,000. These purchases may, all together, not qualify for the immediate write-off.

- Buying a $20,000 item will not ensure you receive $20,000 back in tax. Most people can expect to receive 30c tax benefit for every $1 they spend.

- The asset can be new or second hand. You can pay for it in cash by or using credit to pay off later – as long as it is available for use in your business by 30 June, 2019.

Do you want to discuss a capital purchase leading up to 30 June? Call us on 07 3510 1500 or email

Find out more if you’re a tradie looking to get the most out of your tax return.